Euro (EUR/USD, EUR/CHF) News and Analysis

- Lower eurozone inflation points to June ECB rate cut

- EUR/USD lifts after dovish Fed speak and subdued US activity data

- EUR/CHF rises to significant level of resistance

- For further euro insight throughout the second quarter, read our comprehensive euro Q2 forecast:

Recommended by Richard Snow

Get Your Free EUR Forecast

Lower Eurozone Inflation Points to June ECB Rate Cut

Numerous ECB officials have communicated a preference for the first ECB rate cut to take place in June of this year, something that has only been reinforced by yesterdays lower than expected inflation data for the bloc.

Year on year inflation data for Mach dropped to 2.4% after economists anticipated no change to last month’s 2.6% reading. The ECB will meet again next week Thursday where they are likely to indicate that June presents the favourable time to start cutting interest rates.

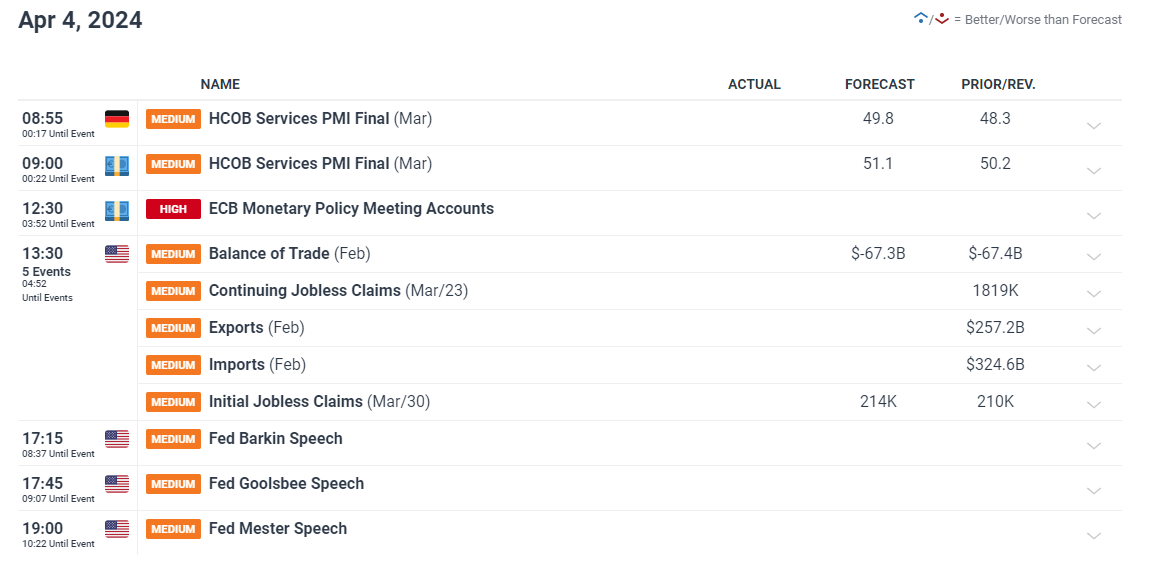

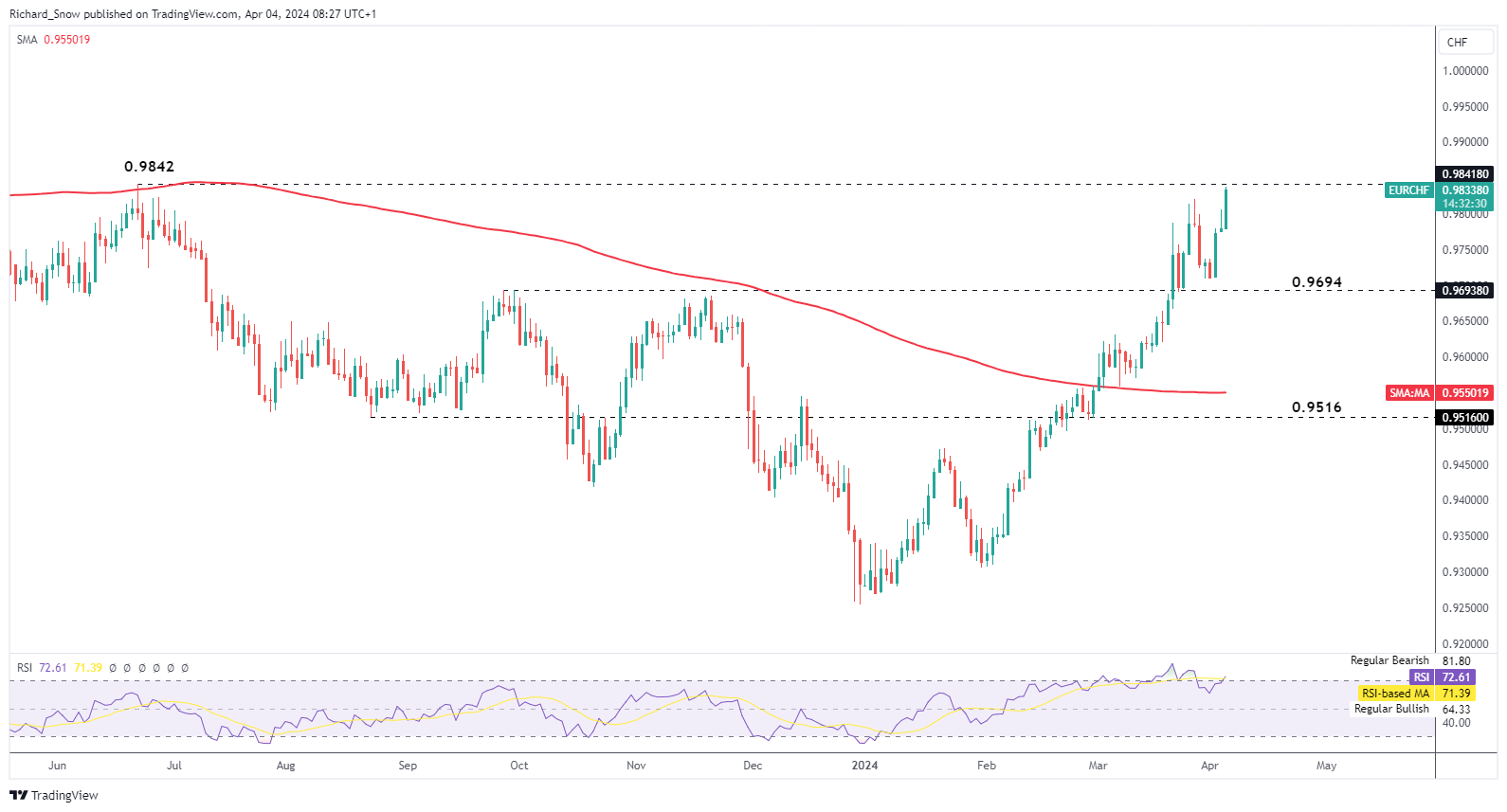

Later this morning, final services PMI data for March are due, with the broader EU data expected to expand further. Thereafter the ECB releases the minutes from the March meeting. Then in the late afternoon, there are more Fed speakers to voice their opinions on current market conditions.

Customize and filter live economic data via our DailyFX economic calendar

EUR/USD Lifts after Dovish Fed Speak and Subdued US Activity Data

The PMI data related to the services sector yesterday revealed a drop in both prices and new orders, helping to contribute to the lower headline reading which remains in expansionary territory for the time being.

Notably, ahead of NFP tomorrow, the employment sub-index rose ever so slightly but remains in contraction (sub 50). The survey fits in with the narrative that the Fed will cut interest rates later this year as the economy appears to be moderating but remains strong on a relative basis when compared to Europe or the UK.

Hence, EUR/USD has managed to recover some lost ground, now trading above the 200 day simple moving average (SMA). Interest rate differentials still heavily favour the US dollar but the euro is enjoying this temporary period of strength against the greenback. Therefore, an extended bullish move may face resistance ahead of the 1.0950 zone. NFP tomorrow is the major event risk of the week and typically FX pairs tend to ease into the report.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Learn how to approach the world’s most traded currency pair and other highly liquid FX pairs via our comprehensive guide below:

Recommended by Richard Snow

Recommended by Richard Snow

How To Trade The Top Three Most Liquid Forex Pairs

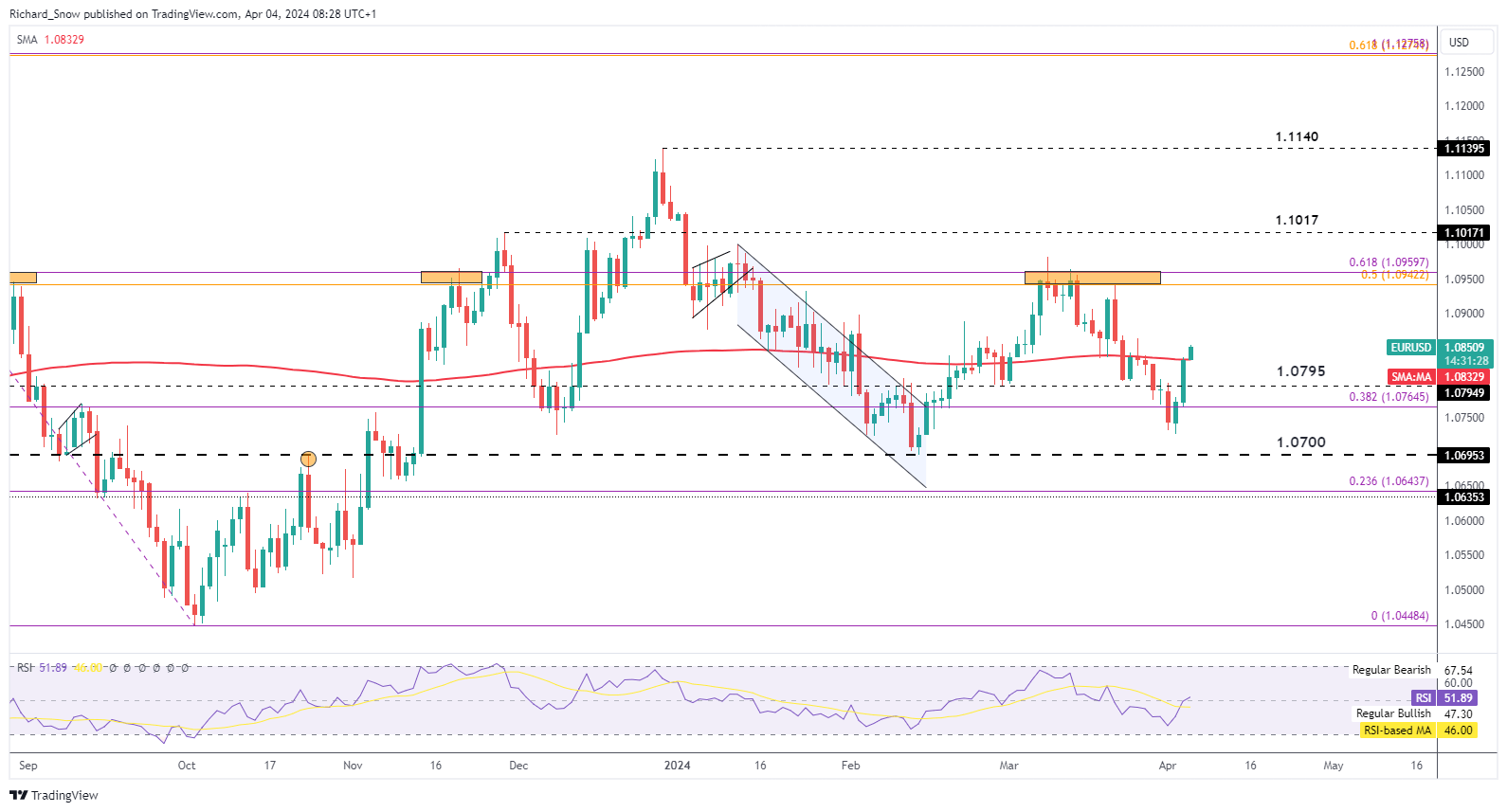

EUR/CHF Rises to Significant Level of Resistance

In the aftermath of the Swiss National Bank (SNB) rate cut, the franc remains vulnerable to further depreciation and this surfaces via EUR/CHF. The bullish move continues to mature, after accelerating in February when the prospect of rate cuts started to filer in.

The pair trades well above the 200 SMA and continues higher after finding support at 0.9694. Resistance is currently in the process of being tested, at the 0.9842 handle last seen in July 2023 at a time when the RSI reveals a return to overbought territory after a temporary exit towards the end of March.

EUR/CHF Daily Chart

Source: TradingView, prepared by Richard Snow

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the second quarter!

Recommended by Richard Snow

Get Your Free Top Trading Opportunities Forecast

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX