British Pound (GBP/USD) News and Analysis

- GBP/USD remains in a well-respected downtrend

- BOE’s Haskel reminded markets that the UK labor market remains tight

- This was perhaps modestly more hawkish than some recent BoE comments

- Elevate your trading skills and gain a competitive edge. Get your hands on the Pound Sterling Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by David Cottle

Get Your Free GBP Forecast

The British Pound is higher against the United States Dollar in Europe on Tuesday, although the overall downtrend endures, rooted in diverging monetary policy expectations.

Earlier in the session Bank of England policymaker Jonathan Haskel said that inflation will be impacted by labor-market tightness, and that that tightness has been falling rather slowly. This reminder that inflation can be hard to beat contrasted somewhat with the more ‘dovish’ commentary from other BOE officials in the recent past and might explain why sterling’s fall has slowed.

However, the backdrop remains one in which UK interest-rate cut forecasts have been brought forward, even as the resilience of the US economy has seen them pushed back appreciably there. Recall that, when 2024 got under way, the smart money was on the Federal Reserve starting to reduce interest rates in March. Well March has come and gone with no sign whatever of lower borrowing costs.

Sterling was once a clear outlier as British inflation remained stubbornly higher than peer economies’. However, things have changed and now the market is pretty sure the BOE will start to cut interest rates in August.

This shift in views is not limited to Sterling, but it’s clear to see why this is not an environment for bulls. That’s why GBP/USD is back down to levels not seen since last November.

The rest of this week offers very little important scheduled data from the UK. In any case there’s little more important data release in the entire global round these days then the US inflation print form the Personal Consumption and Expenditure series. That’s due on Friday and will likely dictate GBP/USD trade at least in the short term.

Expect narrow daily ranges until the markets have seen this.

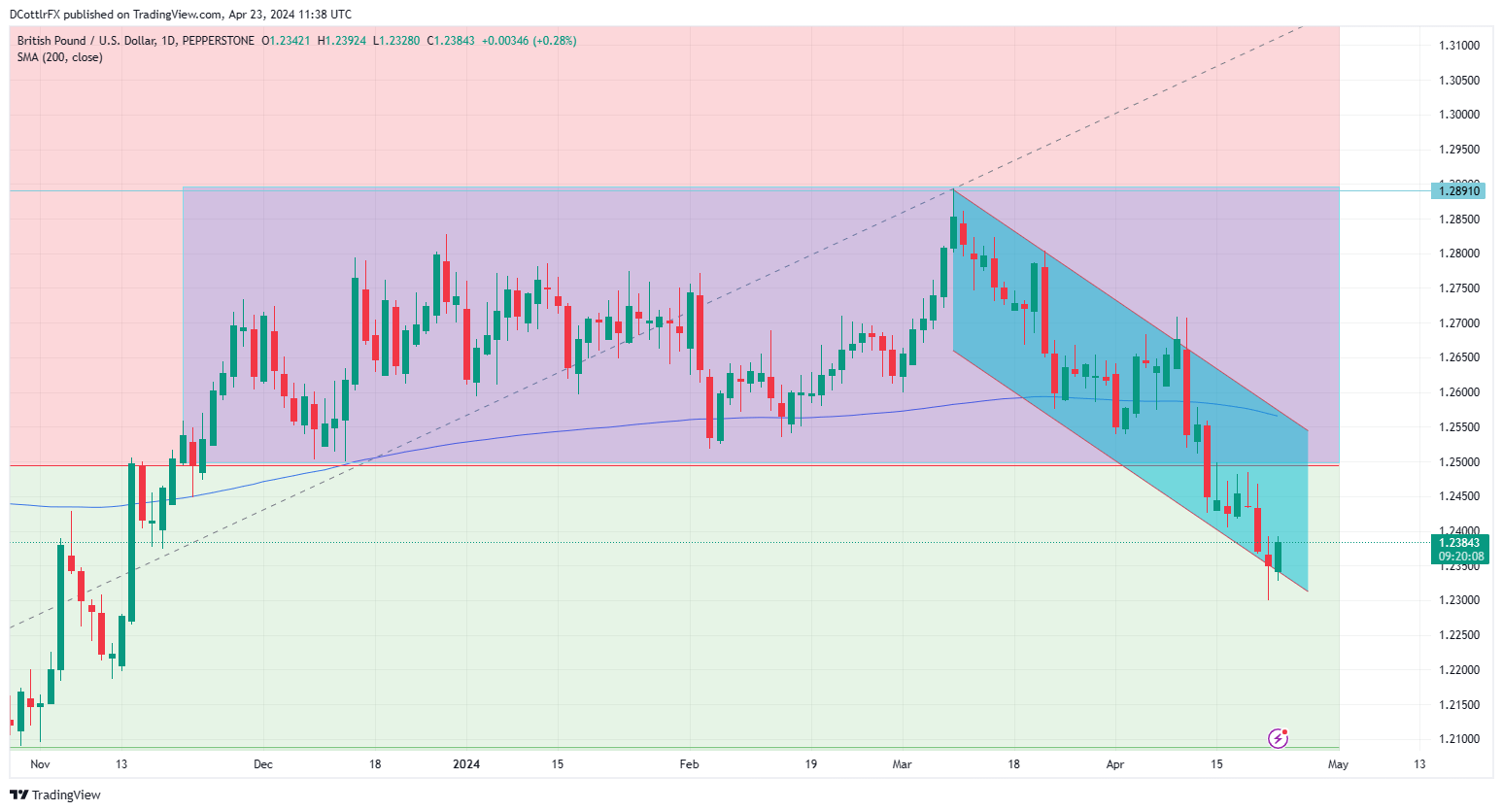

GBP/USD Technical Analysis

GBP/USD Daily Chart Compiled Using TradingView

The parallel downtrend channel from March 7 has been remarkably well respected, at least on a daily closing basis, but is clearly now facing a stern challenge to its lower boundary.

At face value a daily close below it looks like bad news for GBP bulls. They’re going to have to raise their game to stop it given that it currently offers support at 1.2399.

Should that boundary give way, focus will be on retracement support at 1.20906, with November 13’s high of 1.22677 barring the way down to it.

Bulls’ first order of business is to defend that downtrend line. If they can, they’ll need to consolidate gains above psychological resistance at 1.24000 if they are going to retake that retracement level.

IG’s own sentiment data suggests the bulls are in charge at current levels, with over 65% of traders coming to the market expecting gains. However, even if seen, these are likely to be mere consolidation within the broader downtrend

| Change in | Longs | Shorts | OI |

| Daily | -3% | 11% | 1% |

| Weekly | 4% | -2% | 2% |

–By David Cottle for DailyFX