Japanese Yen (USD/JPY) Analysis

- Ueda, Suzuki address parliament on rates and the state of the yen

- USD/JPY respects 155.00 but the playbook suggests possible breach

- Short yen positioning adds to risks of a sharp reversal

- Major event risk: US GDP, PCE, BoJ meeting

- Elevate your trading skills and gain a competitive edge. Get your hands on the Japanese Yen Q2 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar:

Recommended by Richard Snow

Get Your Free JPY Forecast

Ueda, Suzuki Address Parliament on Rates and the State of the Yen

On Tuesday, the Bank of Japan (BoJ) Governor Kazuo Ueda and the Minister of Finance Shunichi Suzuki updated parliament on inflation, interest rates and measures to combat the continued yen weakness.

Ueda, mentioned that rates will need to rise if trend inflation accelerates towards its 2% target as it expects. Friday’s meeting comes with the updated quarterly outlook and was initially eyed as the most likely opportunity for the Bank to raise rates out of negative territory. Having already hiked in March, the BoJ has had to take into account rising price pressures due, in part, to record wage growth, elevated oil prices, and a weaker yen – resulting in imported inflation. The market currently prices in a 10% chance the BoJ hike on Friday.

The Japanese Finance Minister Shunichi Suzuki stressed that the recent trilateral meeting between Japan, South Korea and the US laid the groundwork for Japan to take ‘appropriate action’ in the currency market. At a post-cabinet meeting news conference Suzuki said that authorities are not ruling out any options when it comes to recent volatile JPY moves that are not representative of fundamentals.

Next week’s Golden Week holidays in Japan could represent a low liquidity environment if authorities were to directly intervene in the FX market but the potential outcome remains uncertain.

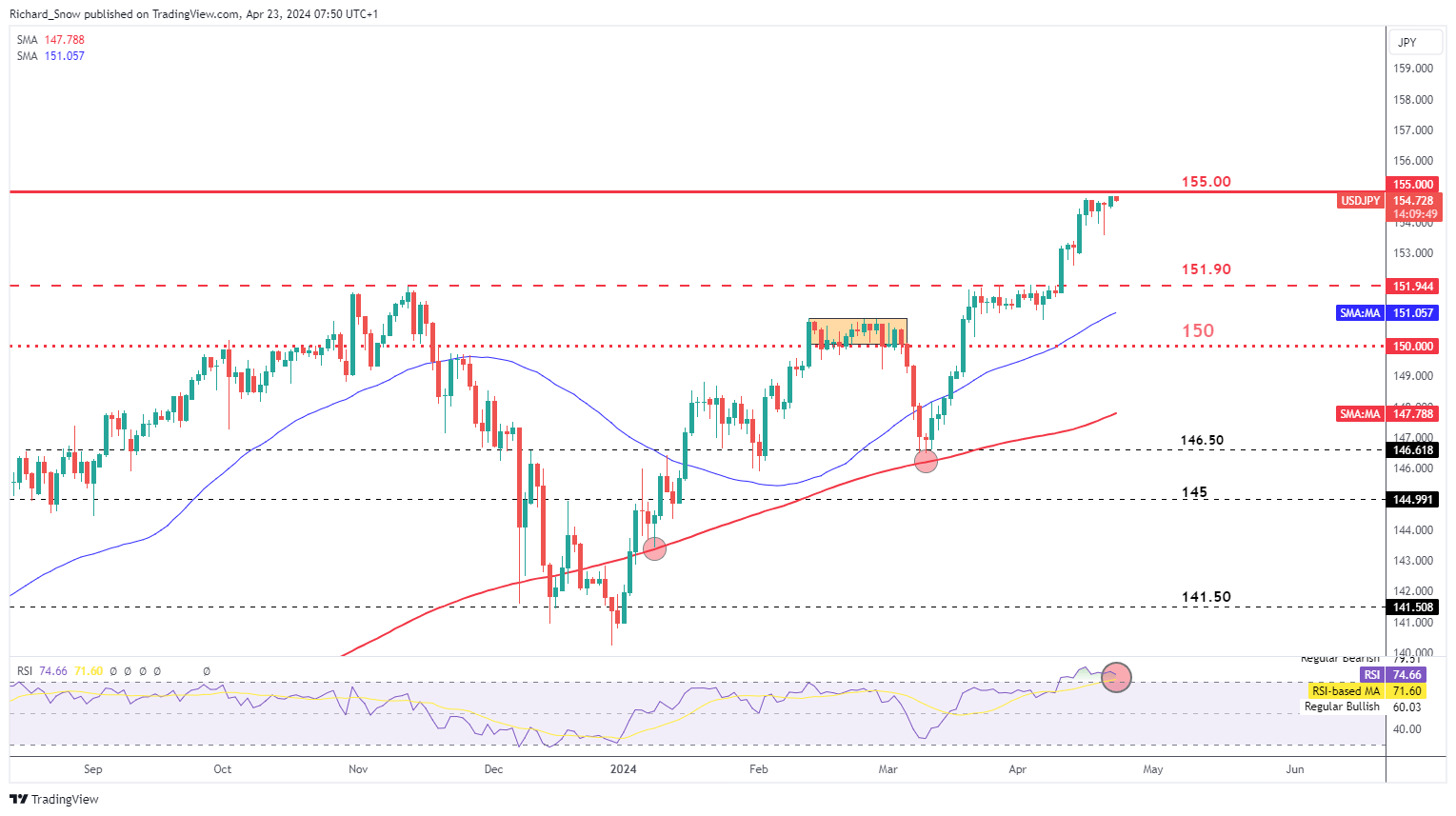

USD/JPY Respects 155.00 But the Playbook Suggests Possible Breach

USD/JPY continue to respect the level of resistance at 155.00 – the level referred to by former vice finance minister Watanabe as a level that is likely to see a direct response from finance officials. However, markets respected the 152.00 level in a similar way before US CPI provided the catalyst to power through the psychological barrier.

This week, we have another inflation print in the form of PCE data that may act as a bullish catalyst again, potentially sending the pair higher. The RSI remains in overbought territory but a strong dollar and lackluster yen suggests this may extend for some time to come. The interest rate differential between the two keeps the carry trade alive and well -adding to the recent yen pressure as markets delay the first Fed cut even further down the line.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

Learn the ins and outs of trading USD/JPY – a pair crucial to international trade and a well-known facilitator of the carry trade

Recommended by Richard Snow

How to Trade USD/JPY

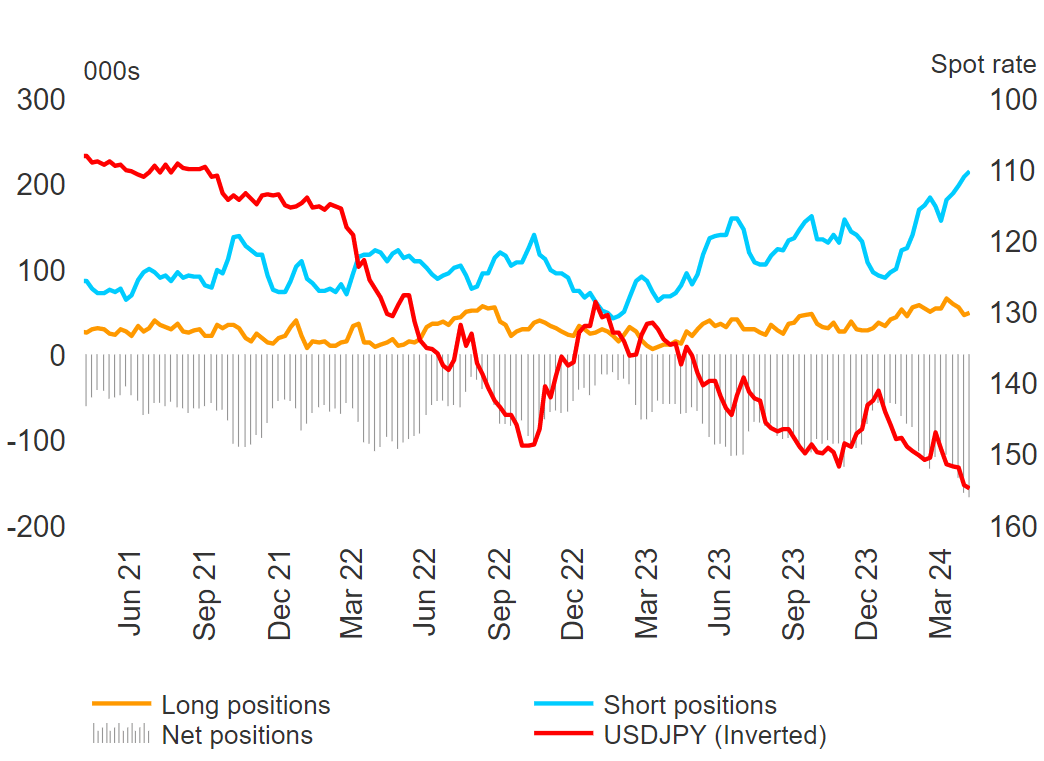

Short Yen Positioning Adds to Risks of a Sharp Reversal

Large speculative institutions like hedge funds and other money managers collectively hold a massive amount of short yen positions that could be unwound very quickly. The ‘smart money’ as they’re often referred to are clearly positioned to benefit from the positive carry but any FX intervention from Tokyo carries the potential for massive volatility and a sharp move lower in USD/JPY. Previous cases if intervention saw around 500 pip moves in the immediate aftermath.

Commitment of Traders (CoT) Report Showing Yen longs, shorts and USD/JPY (inverted)

Source: TradingView, prepared by Richard Snow

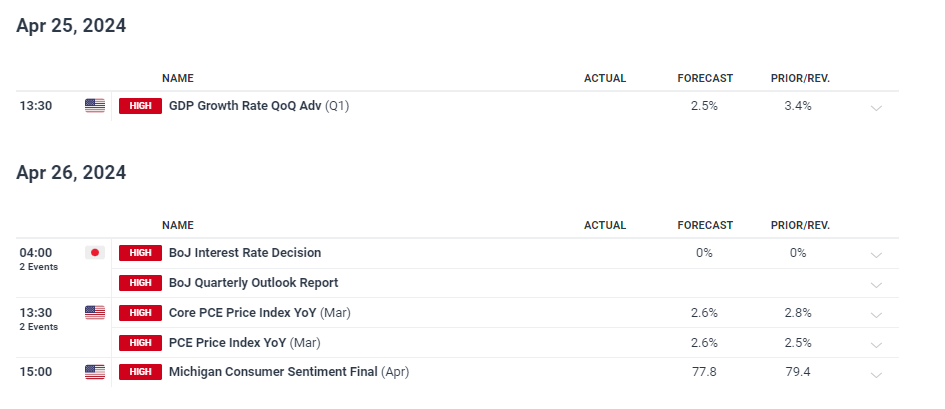

Major Risk Events for the Remainder of the Week

US data welcomes a return to prominence this week with the first look at US first quarter GDP on Thursday before Friday’s busy end to the week with US PCE inflation data and the Bank of Japan rate announcement.

The Atlanta Fed’s GDPNow forecast puts US GDP at 2.9% in Q1 versus the estimate of 2.5%. Either way, the data would represent moderating growth in the US but the economy remains strong on a relative basis – compared to the UK and EU, for example.

The Bank of Japan is set to release its updated quarterly outlook report at Friday’s meeting with a focus on the banks medium term inflation outlook taking into account record wage growth, elevated oil prices (Japan is a net-importer of oil) and a weaker yen all potentially adding to the data point – supporting further BoJ hikes to come.

PCE inflation data is the next data point in what has proven to be a series of hotter prints since the start of the new year. The expectation of 2.6% suggests hotter inflation is expected to continue and a large focus will be directed towards the month-on-month figure for a better idea of recent price pressures.

Customize and filter live economic data via our DailyFX economic calendar

Stay up to date with breaking news and themes driving the market by signing up to out weekly DailyFX newsletter:

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX