Want to stay ahead of the pound‘s next major move? Access our quarterly forecast for comprehensive insights. Request your complimentary guide now to stay informed on market trends!

Recommended by Diego Colman

Get Your Free GBP Forecast

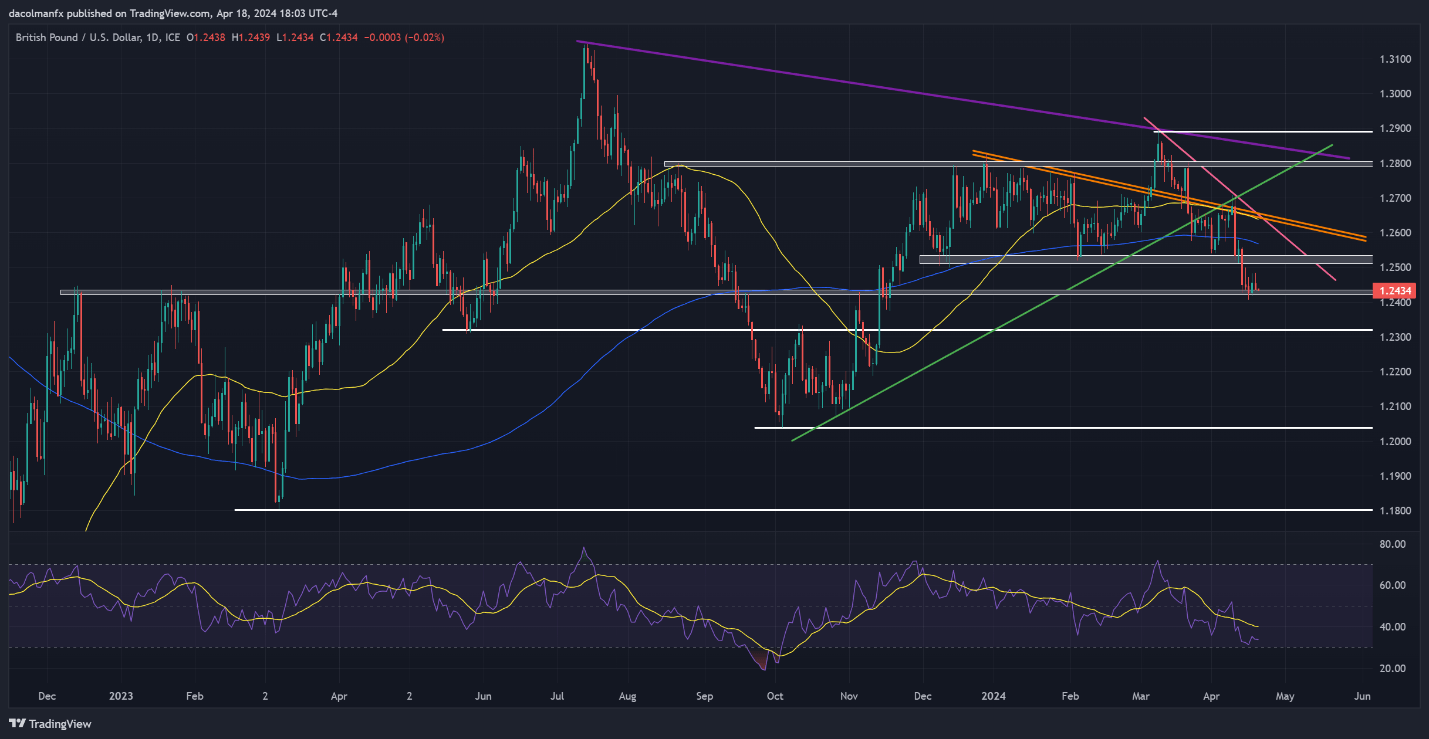

GBP/USD FORECAST – TECHNICAL ANALYSIS

GBP/USD fell moderately on Thursday but remained above support at 1.2430. Bulls must vigorously defend this floor to prevent a deeper pullback; failure to do so may result in a retracement towards 1.2325. Subsequent losses beyond this point may lead to a retest of the October 2023 lows near 1.2040.

On the flip side, if sentiment shifts back in favor of buyers and prices reverse to the upside off current levels, resistance looms at 1.2525. Above this critical barrier, the focus will transition to the 200-day simple moving average at 1.2570, followed by 1.2640, where the 50-day simple moving average aligns with two important short-term trendlines.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView

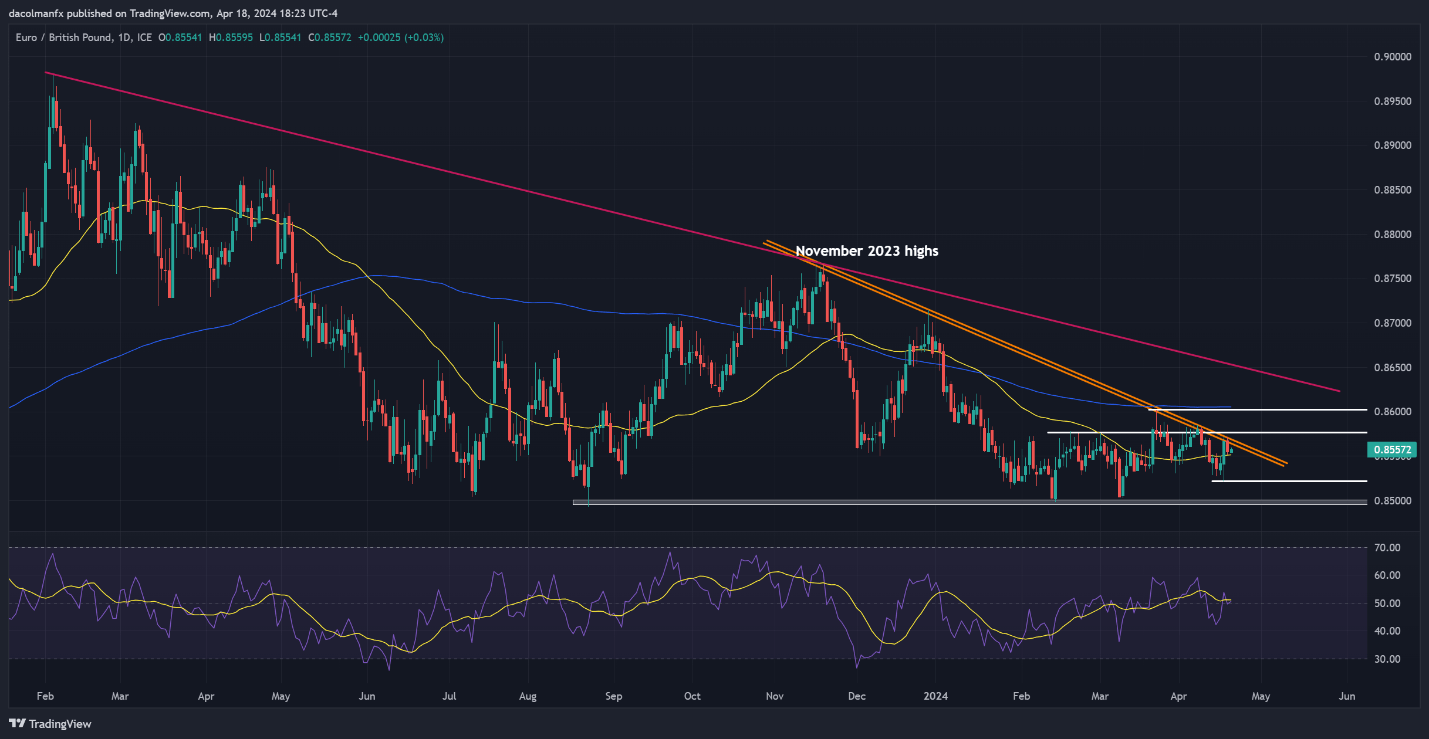

EUR/GBP FORECAST – TECHNICAL ANALYSIS

EUR/GBP rallied earlier in the week but reversed its course on Thursday after failing to clear trendline resistance at 0.8570, with prices dropping towards the 50-day simple moving average at 0.8550. The pair is likely to stabilize around current levels before mounting a comeback, but in the event of a breakdown, a dip towards 0.8520 and potentially 0.8500 could be around the corner.

Alternatively, if bulls manage to reassert dominance and push the exchange rate higher, resistance emerges at 0.8570 as mentioned before. Breaking through this technical obstacle could set the stage for a surge toward the 200-day simple moving average near the 0.8600 handle.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, “Traits of Successful Traders.” Gain access to crucial tips to help you avoid common pitfalls and costly errors.

Recommended by Diego Colman

Traits of Successful Traders

EUR/GBP PRICE ACTION CHART

EUR/GBP Char Creating Using TradingView

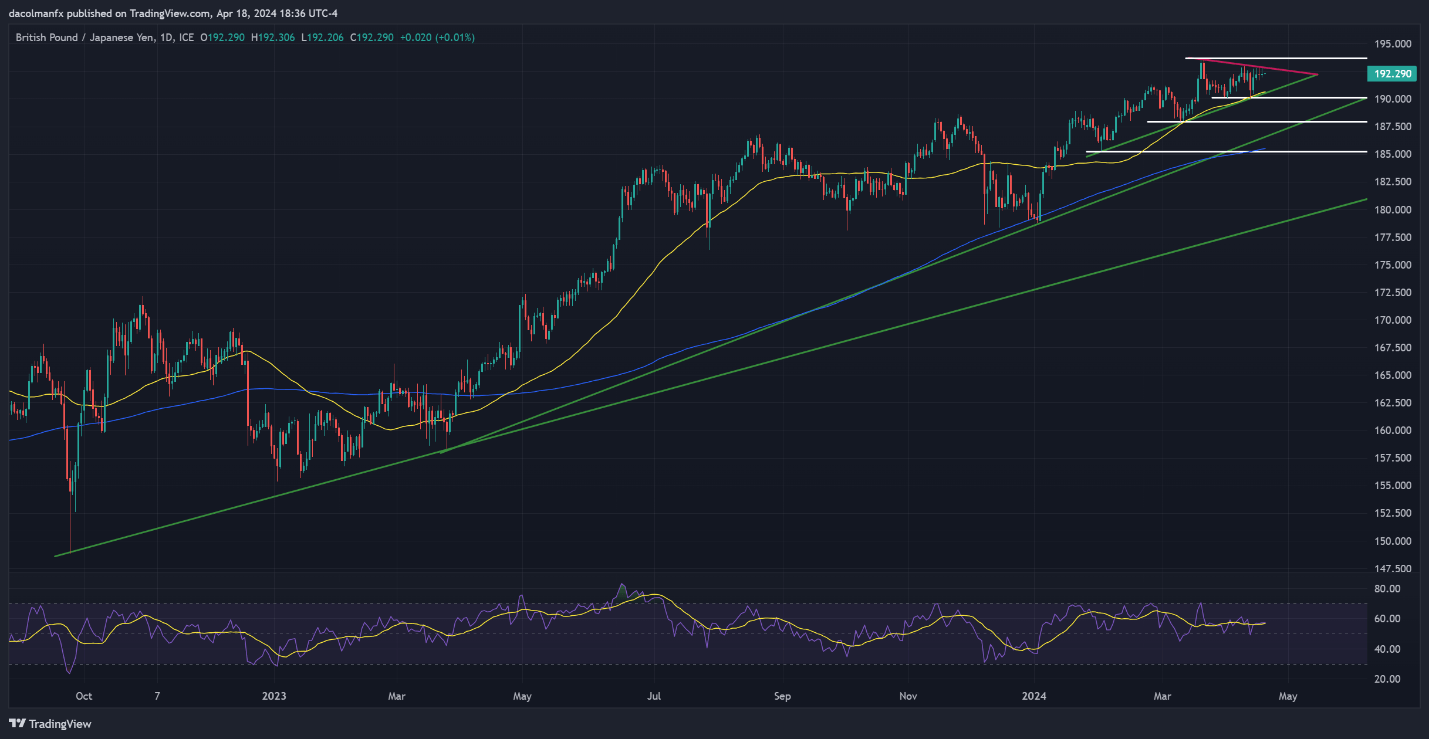

GBP/JPY FORECAST – TECHNICAL ANALYSIS

GBP/JPY was largely flat on Thursday, trading slightly below trendline resistance at 192.70. Bears need to protect this ceiling tooth and nail; any lapse could spark a move towards the 2024 highs at 193.55. On further strength, a jump towards the psychological 195.00 mark cannot be ruled out.

On the other hand, if the pair gets rejected from its current position and pivots to the downside, support stretches from 190.60 to 190.15, where a rising trendline converges with the 50-day simple moving average and April’s swing lows. Additional losses below this floor could reinforce bearish impetus, opening the door for a drop towards 187.90.

Want to understand how retail positioning may impact GBP/JPY’s trajectory? Our sentiment guide holds all the answers. Don’t wait, download your free guide today!

| Change in | Longs | Shorts | OI |

| Daily | -1% | 3% | 2% |

| Weekly | -8% | 3% | 0% |

GBP/JPY PRICE ACTION CHART

GBP/JPY Chart Created Using TradingView