GBP/USD and EUR/GBP Analysis and Charts

Most Read: British Pound Weekly Forecast – Lighter Data Week Could Mean Some Respite

Our brand new Q2 British Pound Forecast is available to download for free below:

Recommended by Nick Cawley

Get Your Free GBP Forecast

UK inflation will continue to fall towards target, and potentially quicker-than-originally predicted, according to the governor and deputy governor of the Bank of England. Earlier this week governor Bailey said that inflation was moving lower and ‘in the right direction’ for a cut and that the UK is ‘disinflating at what I call full employment…strong evidence now that the process is working its way through’.

Late Friday, BoE deputy governor Dave Ramsden said that he has now ‘become more confident in the evidence that risks to persistence in domestic inflation are receding, helped by improved dynamics.’ Ramsden added that relative to the February official forecasts risks to inflation are pointed to the downside, ‘with a scenario where inflation stays close to the 2% target over the whole forecast period at least as likely.’ The BoE forecast for a three-year period.

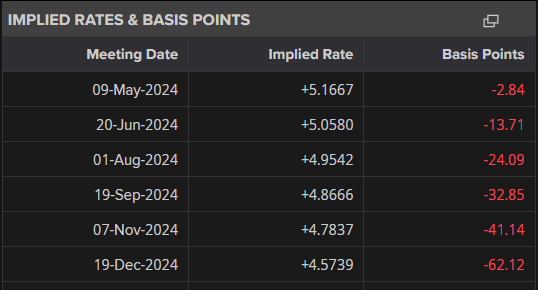

The latest UK rate cut probabilities have shifted forward with the first 25 basis point cut now expected at the August 1st central bank meeting.

For all central bank meeting dates. See the DailyFX Central Bank Calendar

For all market-moving economic data and events, see the DailyFX Economic Calendar

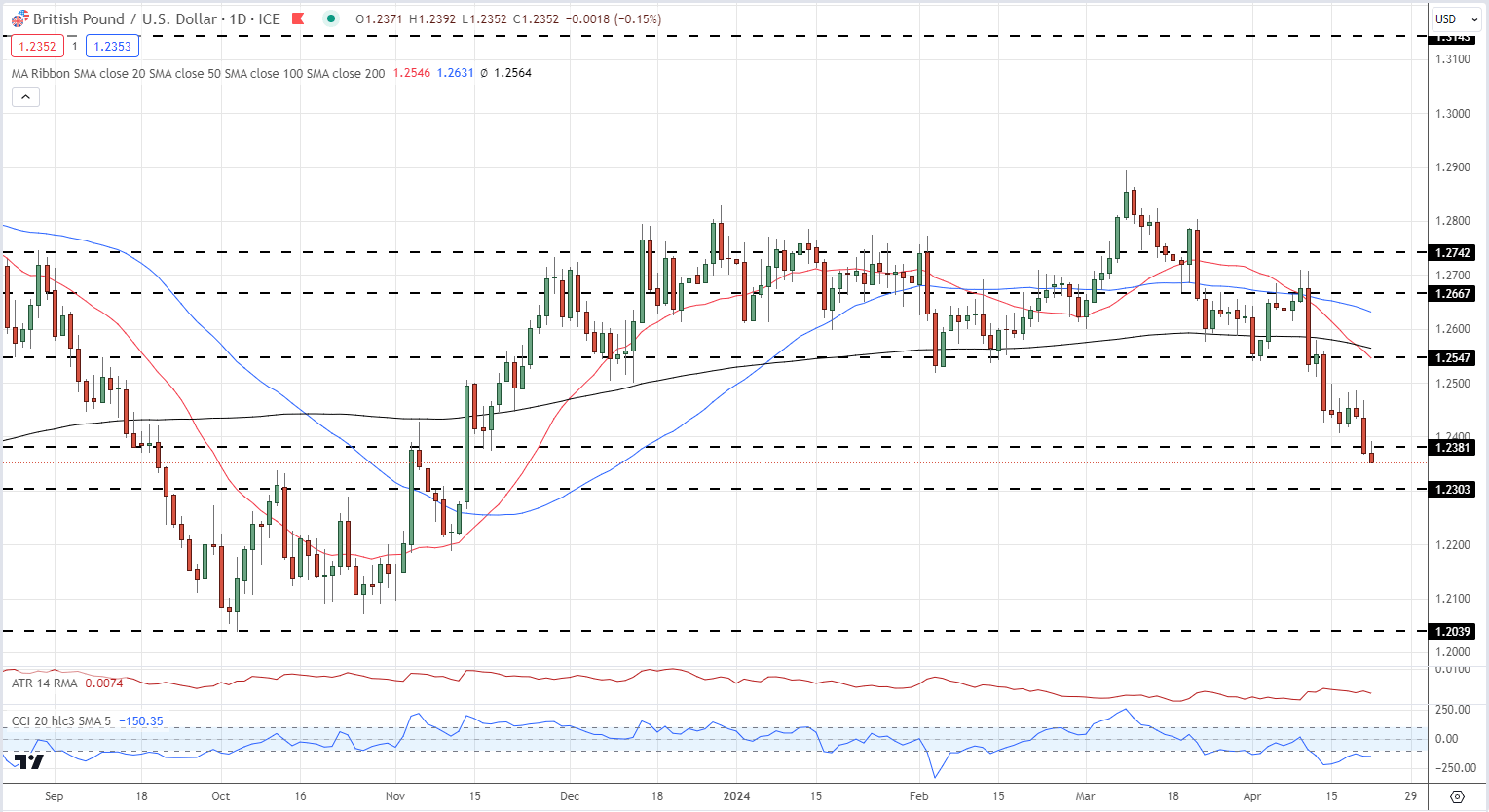

With UK rate cuts now seen earlier, the British Pound is weakening across the board. Against a resilient US dollar, cable has now fallen below 1.2400 and seems set to test the 1.2313 (61.8% Fibonacci retracement) and then the 1.2303 level. Below here, big figure support at 1.2200 and 1.2100 before 1.2039 comes into focus.

Recommended by Nick Cawley

How to Trade GBP/USD

GBP/USD Daily Price Chart

IG Retail data shows 71.54% of traders are net-long with the ratio of traders long to short at 2.51 to 1.The number of traders net-long is 0.56% lower than yesterday and 1.64% higher from last week, while the number of traders net-short is 2.07% higher than yesterday and 5.74% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

See How Changes in IG Client Sentiment Can Help Your Trading Decisions

| Change in | Longs | Shorts | OI |

| Daily | 0% | 7% | 4% |

| Weekly | -41% | 93% | -4% |

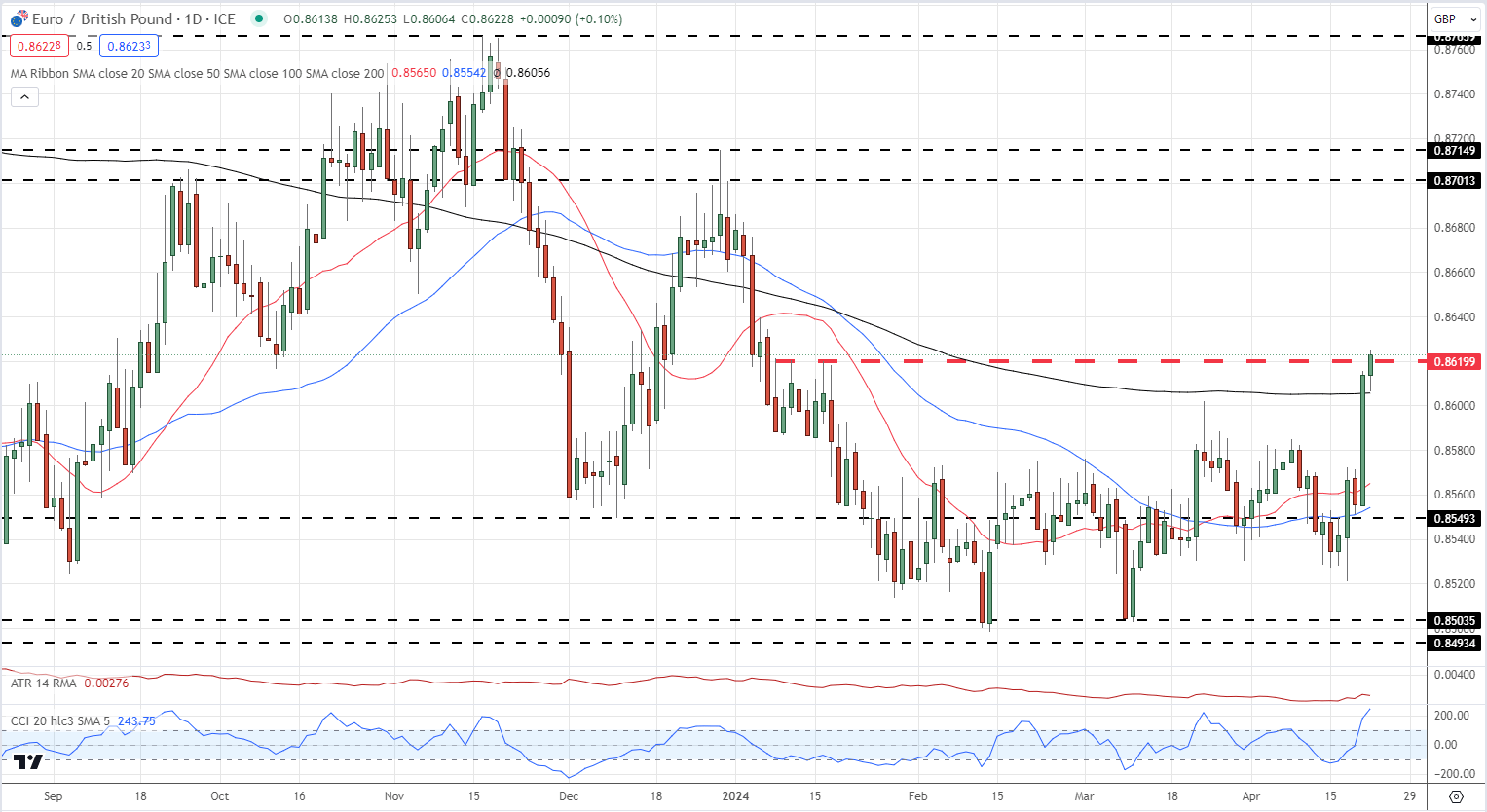

Sterling’s weakness can be seen a little better against the Euro. The ECB is fully expected to cut rates by 25 basis points in June, and potentially again in July, leaving the ECB ahead of the BoE in the rate-cutting cycle. Despite this, the Euro strengthened sharply against the British Pound at the end of last week and is looking to build on those gains today. A clear break of 0.8620 would leave 0.8701 and 0.8715 as the next resistance levels.

EUR/GBP Daily Price Chart

What is your view on the British Pound – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.