Recommended by Daniel Dubrovsky

Get Your Free Gold Forecast

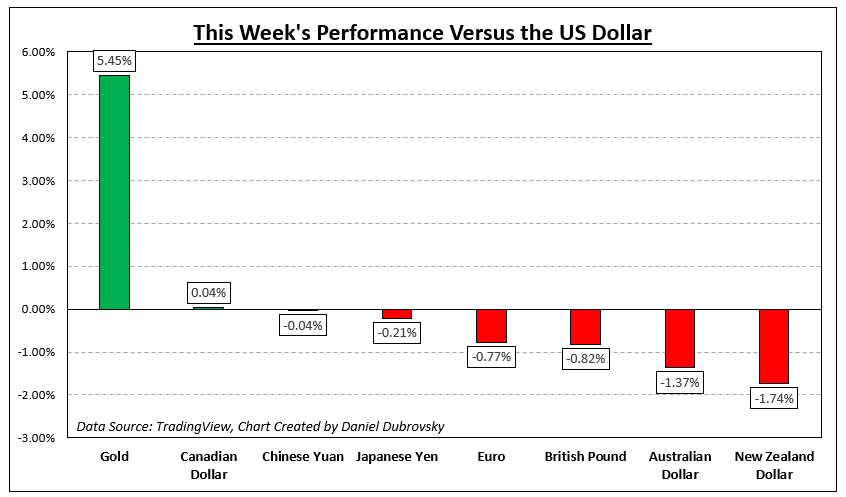

It was a volatile week for certain corners of financial markets over the past few trading sessions. All eyes were on gold and crude oil prices. XAU/USD rallied almost 5.5 percent, marking the best 5-day period since the middle of March. Meanwhile, crude oil prices soared almost 6 percent in the best weekly gains since the end of August.

Turmoil in the Middle East in the aftermath of Hamas’s attack on Israel fueled oil supply disruption woes with respect to potential geopolitical volatility around Iran. Meanwhile, cautious Fedspeak helped cool government bond yields. The latter offered support to gold prices, which are very sensitive to Treasury yields and the Federal Reserve.

Focusing on currencies, the sentiment-linked New Zealand and Australian Dollar underperformed against the US Dollar amid a deterioration in global stock markets heading into the end of last week. While the S&P 500 and Nasdaq 100 started off the week strong, most of the gains were reversed heading into the weekend.

Looking at the week ahead, there are a few notable event risks. Fed Chair Jerome Powell will be speaking on Thursday and his language will be in focus given the somewhat cautious Fedspeak of late. Elsewhere, China will be releasing the latest GDP figures. All eyes will be on a slowing in growth. The UK will release employment figures while Canada reports inflation. What else is in store for financial markets in the week ahead?

Recommended by Daniel Dubrovsky

Get Your Free Oil Forecast

How Markets Performed – Week of 10/9

Forecasts:

British Pound (GBP) Forecast: GBP/USD and EUR/GBP Eye Inflation and Jobs Data

Sterling-pairs will be driven by the latest UK jobs and inflation reports next week. Will they show that the Bank of England was correct in leaving UK rates untouched?

Australian Dollar Forecast: US Dollar Dominates AUD/USD While AUD/JPY Ranges

The Australian Dollar retreated from a 2-week high last week with the US Dollar regaining its ascendency on the back of a hot inflation print in the US. Where to for AUD/USD and AUD/JPY.

S&P 500 and Nasdaq 100 Forecast for the Week Ahead: Which Directional Bias Will Prevail?

The S&P 500 and Nasdaq 100 face mixed outlooks since there is a case for a broader bullish bias and a near-term bearish outlook. What are key levels to watch ahead?

Crude Oil Forecast: Threat of Broader Conflict, Sanctions Spooks Oil Markets

Friday the 13th witnessed a surge in oil prices ahead of the weekend as Israel threatens to take the war to another level.

Gold and Silver Price Forecast: Geopolitics Send XAU/USD & XAG/USD Flying

This article examines the outlook for gold and silver for the coming weeks, analyzing the geopolitical and technical factors that could guide the trajectory of these key precious metals.

US Dollar Forecast: DXY at the Mercy Geopolitical Developments

The Dollar Index (DXY) roared back to life as concerns of escalation and spread in the Middle East has seen the US Dollar benefit from its safe have appeal and remains key in the week ahead.

— Article Body Written by Daniel Dubrovsky, Contributing Senior Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members