BITCOIN, CRYPTO KEY POINTS:

- Fake News Blunder of ETF Approval Sends Bitcoin into a Frenzy. A Large Position of Gains Have Since Been Wiped Away.

- Binance to Stop Accepting New UK Clients Today as it Searches for Partner Authorized by the FCA to Approve Ads.

- Today’s Brief Spike a Sign of the Potential Rally Which Could Unfold Should Spot ETFs be Approved.

- To Learn More AboutPrice Action,Chart Patterns and Moving Averages,Check out the DailyFX Education Series.

READ MORE: US Dollar Forecast: DXY at the Mercy Geopolitical Developments

FAKE BLACKROCK ETF NEWS SENDS BITCOIN SOARING

Bitcoin prices have had a volatile start to the US session as cryptocurrency-news platform Cointelegraph broadcasted news that the iShares Bitcoin ETF (BlackRock Group) had been approved. The news saw Bitcoin spike to a session high of $29900 while simultaneously dragging the Crypto markets as a whole higher with Ethereum spiking to around the $1670 mark.

Elevate your trading skills and gain a competitive edge. Get your hands on the Bitcoin outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Zain Vawda

Get Your Free Bitcoin Forecast

As it turned out the news was fake but with the modern day we live in the news had already spread like wildfire as evidenced by the spike in prices. Cryptotelegraph have come under scrutiny in light of the false news which stated that the BlackRock spot Bitcoin ETF (known as iShares) had been approved which led to the 10%+ spike in BTCUSD to within a whisker of the psychological $30000 mark. First signs that the news was false were delivered by Fox News Reporter Eleanor Terrett who in a tweet revealed that BlackRock confirmed the news as false with the application still under review by the SEC. Cointelegraph have since posted an apology n their X page while promising to provide an update shortly on the manner and reason for the fake news being disseminated.

Gauging the market reaction to the news and we can see the impact and volatility brought about by the supposed news. One can only imagine the impact should the SEC actually approve the BlackRock ETF and many other currently under review. This has been discussed in depth my Q4 Bitcoin Forecast. I had been expecting a potential approval to a be significant step for Bitcoin and crypto markets as a whole. Looking at Bitcoin though I believe it opens up the worlds’ largest cryptocurrency to a significant influx on institutional funds in an ever-changing financial landscape.

Source: FinancialJuice

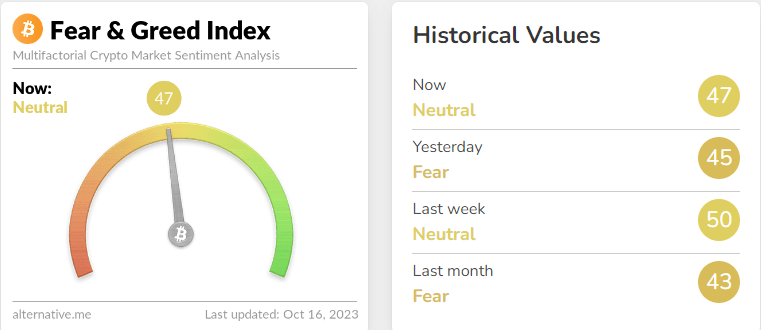

The Crypto Fear and Greed index remains I neutral territory for now, but I would expect a change here as well should a spot ETF be approved. The mood in crypto has become rather somber in the second half of 2023 and a catalyst such as this may be just what the doctor ordered.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: HOW TO USE TWITTER FOR TRADERS

BINANCE STOPS ACCEPTING NEW UK CLIENTS AND OTHER CRYPTO NEWS

As all eyes are focused on the FTX trial currently underway, Cryptocurrency Platform Binance announced that it will stop accepting new users from the UK. This is expected to come into effect on Monday October 16 at 5PM UK Time. The move comes about as Binances local partner in the UK was restricted from approving crypto Ads, a move announced by the FCA last week.

The new crypto marketing rules came into effect in the UK on October 8 with firms registered with the FCA allowed to approve their own Ads or have authorized entities approve it for them. The move by Binance does appear to be a temporary one as the company confirmed that it is ”working closely with the FCA to ensure that our users are not harmed by these developments and are looking to find another suitable FCA authorized firm to approve our financial promotions as soon as possible.”

The US SEC also missed its deadline to appeal the Grayscale application to convert its Bitcoin Trust Fund into an exchange-traded fund (ETF). This after a court decided the refusal by the SEC was unlawful and urged the Regulator to reconsider.

TECHNICAL OUTLOOK AND FINAL THOUGHTS

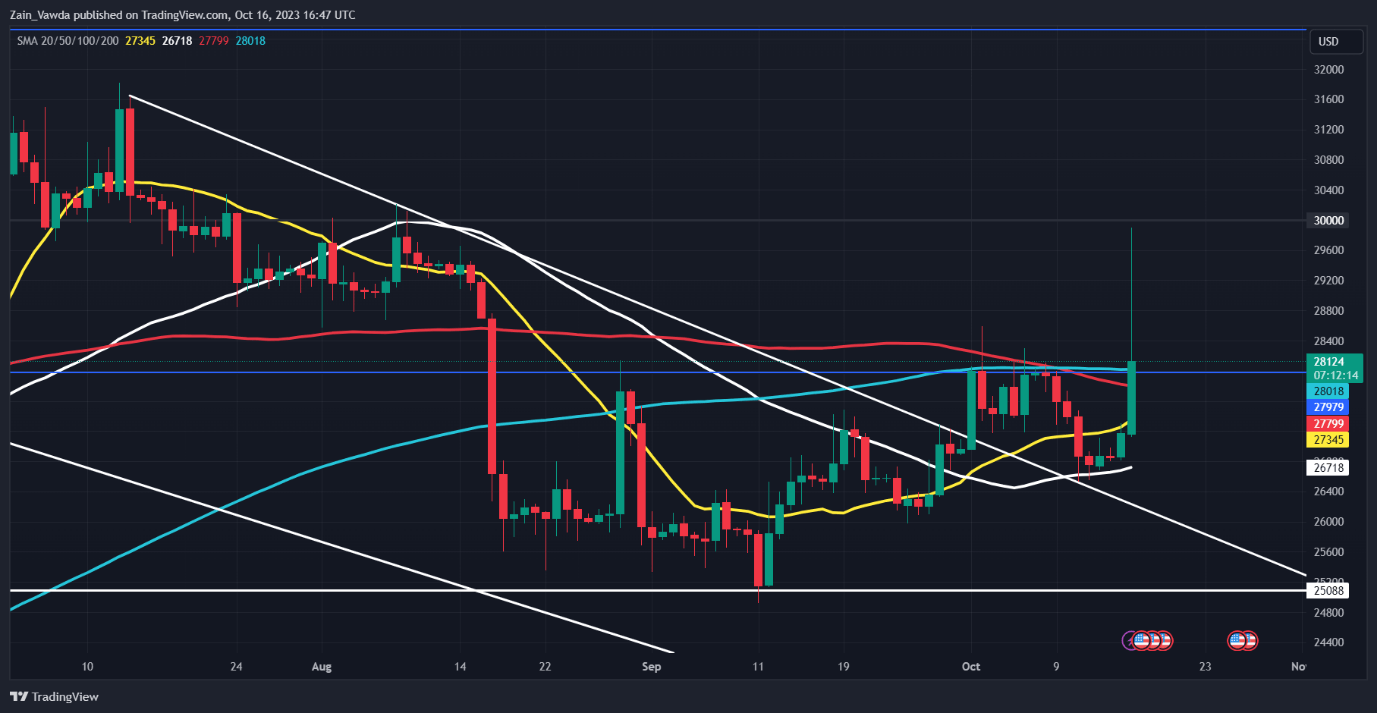

From a technical standpoint BTCUSD is following the perfect breakout, retest and continuation model following a trendline break. Last week saw a death cross formation which at least had some follow through before Bitcoin found support at the 50-day MA resting around the $26500 handle.

A daily candle close above the 100 and 200-day MA could help spur on further upside but a break of the $30000 mark is likely to require a catalyst. Rangebound price action may persist over the coming days as market participants await the SEC decision which could be the catalyst needed to push Bitcoin sustainably above the $30000 handle.

BTCUSD Daily Chart, October 16, 2023.

Source: TradingView, chart prepared by Zain Vawda

Looking for actionable trading ideas? Download our top trading opportunities guide packed with insightful tips for the fourth quarter!

Recommended by Zain Vawda

Get Your Free Top Trading Opportunities Forecast

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda