Canadian CPI, USD/CAD Analysis

- Canadian inflation slows more than expected in February – raising USD/CAD

- Markets bring a potential BoC cut closer while delaying the onset of Fed cuts

- USD/CAD’s bullish response tapered off but pair heads for channel resistance

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Trading Forex News: The Strategy

Canadian inflation slows more than expected in February – raising USD/CAD

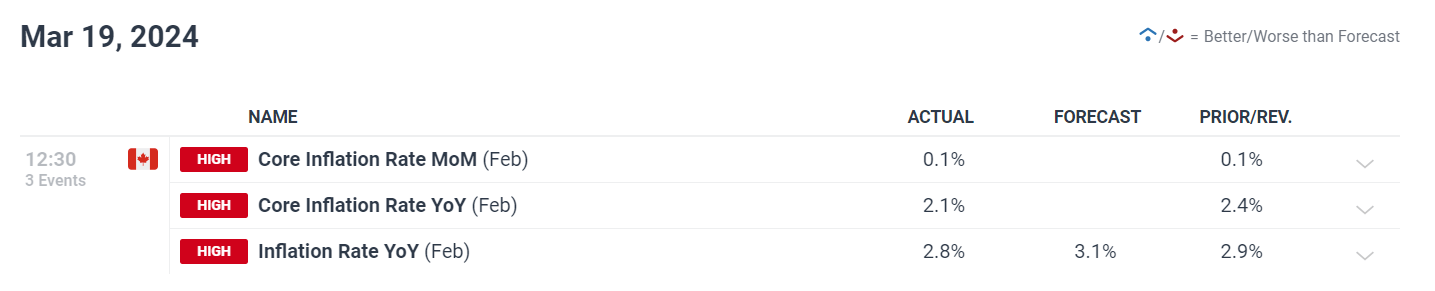

Canadian inflation, both core and headline measures, came in lower than last month’s figures while CPI came in well below the 3.1% estimate, at 2.8%. The core measure eased to lows not seen in more than two years – adding pressure to the Bank of Canada to start contemplating when it may be appropriate to loosen financial conditions.

Customize and filter live economic data via our DailyFX economic calendar

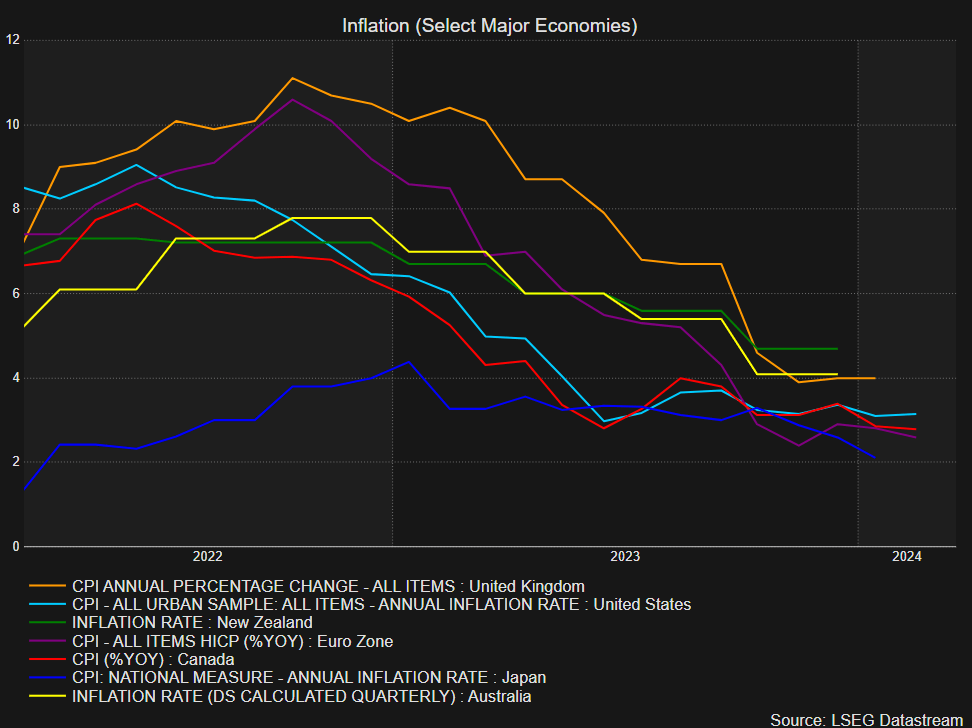

The graph below depicts the inflation rate for selected major economies, showing Canada (red line) as one of the standouts, particularly when compared with countries that witnessed inflation of 8% plus.

Annual Percentage Change in Inflation (CPI)

Source: Refinitiv Workspace, prepared by Richard Snow

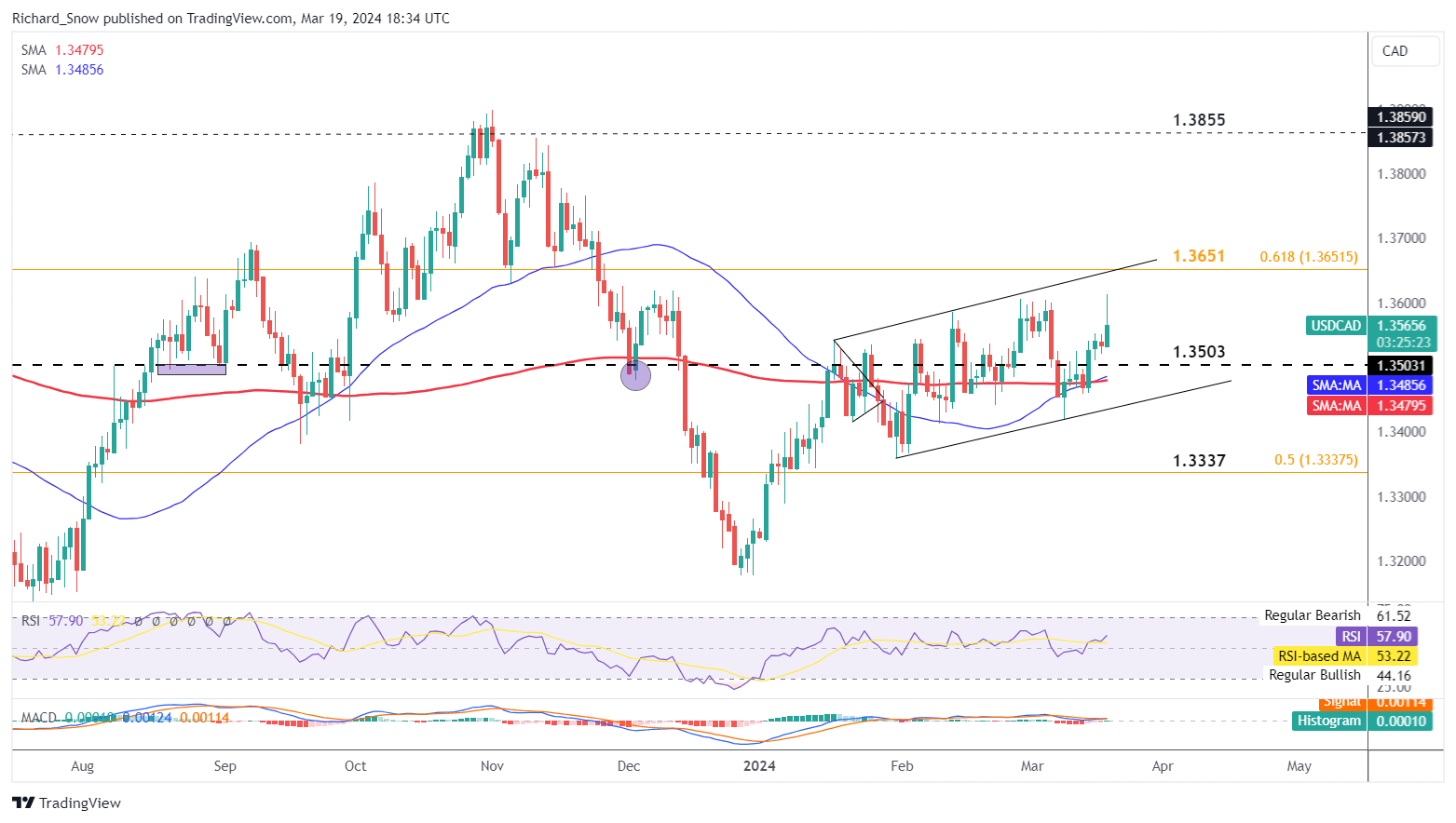

USD/CAD’s Bullish Response Tapered off but Pair Heads for Channel Resistance

USD/CAD continued the bullish move in the moments following the softer inflation data but as the Ney York session continued, lost a bit of steam. The current bullish move stemmed from a test and bounce of channel support at 1.3420, breaking above the 200-day simple moving average (SMA) and 1.3500 in the process.

1.3500 posed as support as far back as October 2022 and has reappeared to provide either support or resistance thereafter. The current directional move has its sights set on a test of channel resistance which is likely to coincide with the 61.8% Fibonacci retracement of the major 2020 to 2022 move (1.3651). However, the massive upper wick developing today, could signal that bulls may need to regroup before another push higher. Canada has been one of the standouts when it comes to bringing inflation back at a reasonable level and currently falls within the 1-3% band typically targeted by the Bank.

USD/CAD Daily Chart

Source: TradingView, prepared by Richard Snow

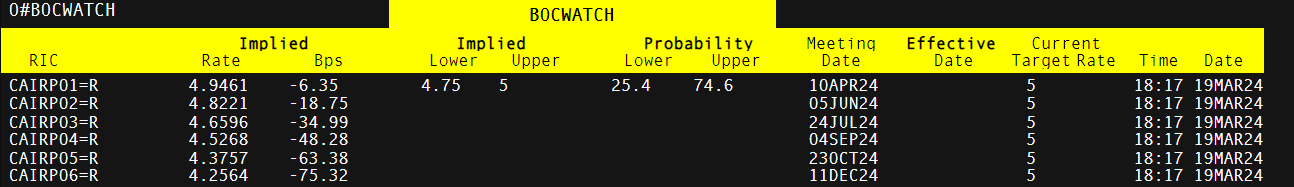

Implied probabilities via rates markets suggests that the Bank of Canada may have to gear up for a first rate cut in June as markets assign roughly 62% chance of a cut at the mid-year mark. Cad may continue to come under pressure as persistently lower inflation provides a strong reason to consider easing monetary policy in an effort to restrain the economy less.

On the other hand, markets are pushing back estimates of when the Fed may cut interest rates from June to July. Delaying monetary easing in this fashion naturally support the dollar as the greenback is likely to enjoy a superior interest rate differential compared to most G7 currencies, for a little while longer.

Source: Refinitiv

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX