EUR/USD Prices, Charts, and Analysis

- The German economy is struggling according to five leading economic institutes.

- Two ECB rate cuts before the August holiday break?

Learn How to Trade EUR/USD with Our Complimentary Guide

Recommended by Nick Cawley

How to Trade EUR/USD

The German economy is in trouble and is expected to expand by the barest of margins in 2024, according to five leading economic research institutes. The institutes have revised their change in German GDP in the current year, ‘significantly downward by 1.2 percentage points to 0.1%, compared to their fall report.’ The German government recently cut their 2024 growth forecast to just 0.2%, with one official saying that the country’s economy is in ‘troubled waters’. The German economy contracted by 0.3% in Q3 2023 and by 0.2% in the fourth quarter.

Joint Economic Forecast Spring 2024

For all market-moving economic data and events, see the real-time DailyFX Economic Calendar

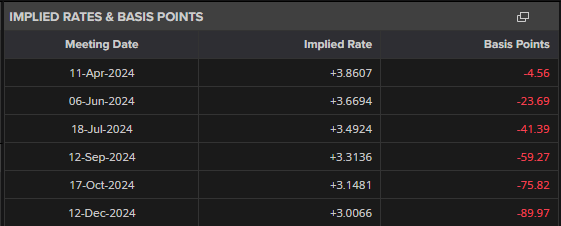

The European Central Bank (ECB) is expected to cut its borrowing rate by 25 basis points at the June 6th policy meeting, and according to current market pricing, they may cut again in July, ahead of the August holiday season. The German economy will need the ECB to aggressively unwind its current restrictive monetary policy so that it can grow in the second half of the year.

Recommended by Nick Cawley

Recommended by Nick Cawley

Master The Three Market Conditions

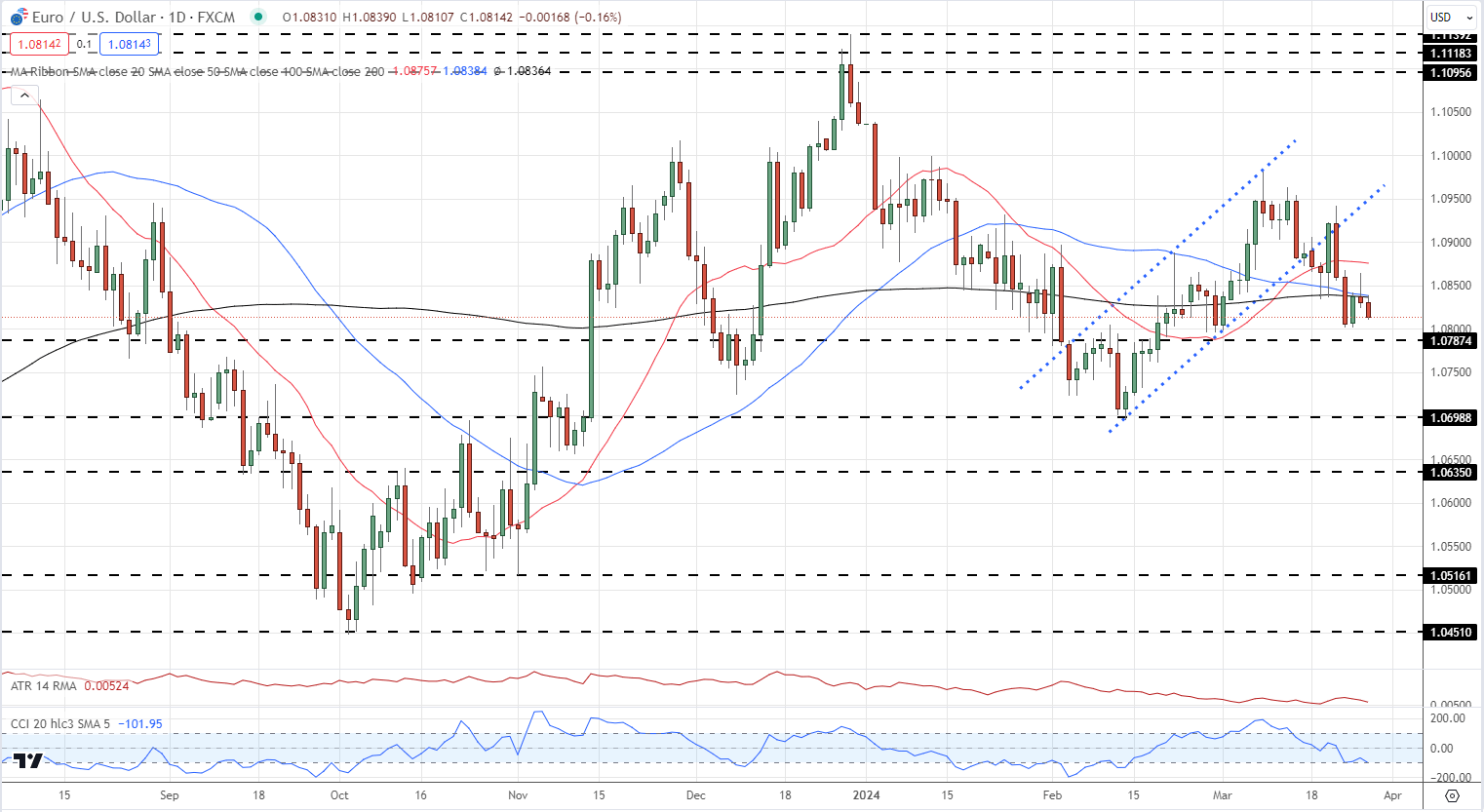

EUR/USD is trading around 1.0815, a fraction above the recent double 1.0800 low. The US dollar has regained some strength in recent days and a combination of a strong USD/weak EUR will likely see the pair test this recent low shortly. Below here, 1.0787 comes into focus ahead of the mid-February lows seen at a fraction under 1.0700.

EUR/USD Daily Price Chart

Charts using TradingView

Retail trader data shows 54.96% of traders are net-long with the ratio of traders long to short at 1.22 to 1.The number of traders net-long is 5.09% higher than yesterday and 3.17% lower from last week, while the number of traders net-short is 1.29% higher than yesterday and 3.11% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

| Change in | Longs | Shorts | OI |

| Daily | 14% | -5% | 5% |

| Weekly | -2% | 1% | 0% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.