Bitcoin (BTC), Ethereum (ETH), Coinbase (COIN) – Prices, Charts, and Analysis:

- Bitcoin – Bullish descending channel breakout.

- Ethereum – Moving higher but still underperforming.

- Coinbase – Moving higher on increased market turnover.

Recommended by Nick Cawley

Get Your Free Introduction To Cryptocurrency Trading

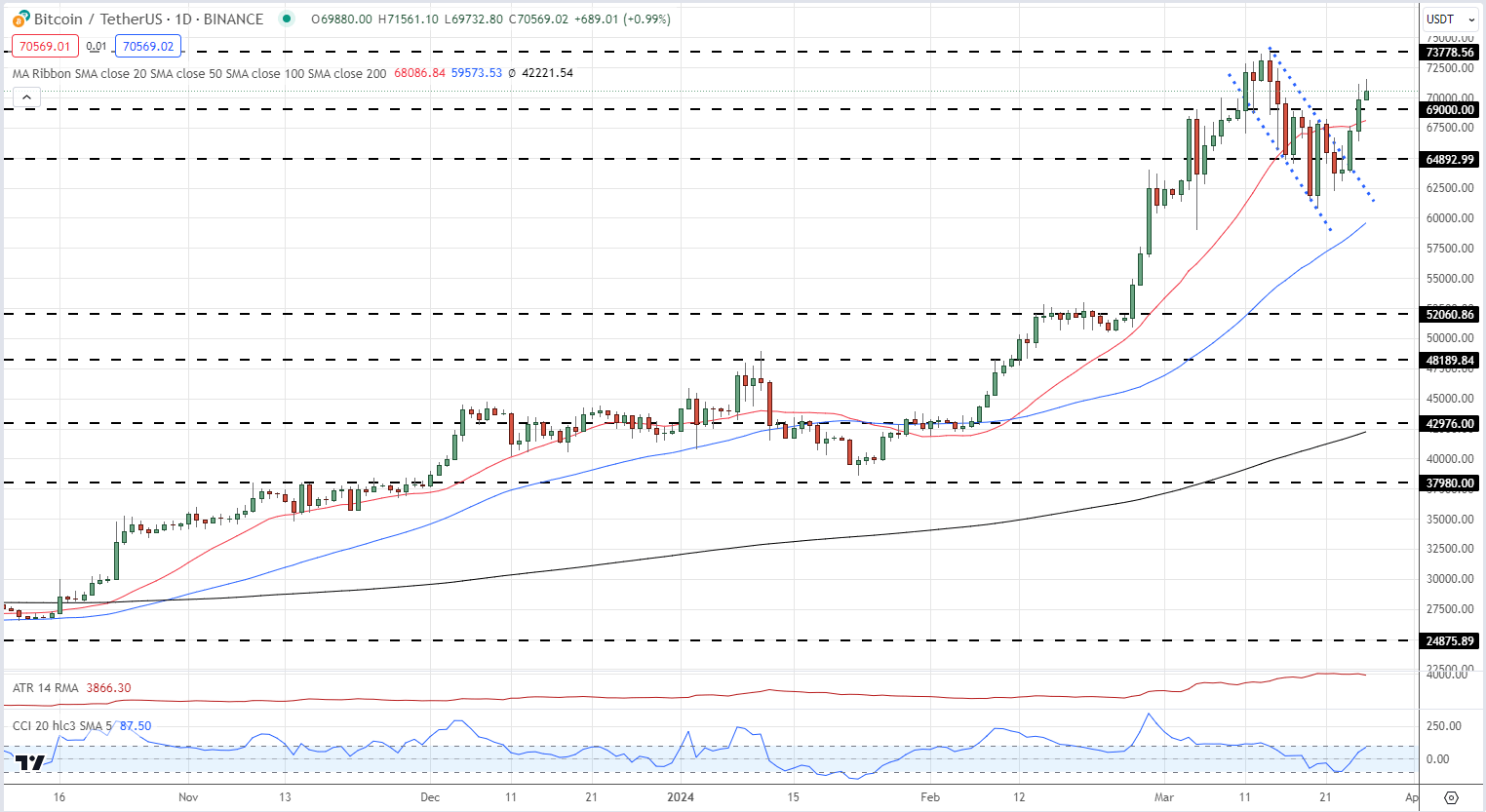

Bitcoin has rallied by around 12% since Sunday’s opening print as demand for the largest cryptocurrency by market cap continues to increase prices. A technical, bullish, break of a short-term descending channel now suggests that Bitcoin will attempt to make a fresh record high in the near-term and likely ahead of next month’s halving event. Any pullbacks will find initial support around $69k before just under $65k comes into focus. The Average True Range (ATR) reading is at a multi-month high, while the CCI indicator shows Bitcoin nearing overbought territory. The chart set-up suggests Bitcoin will move higher over the coming days but a short-term turn lower cannot be discounted.

Bitcoin Halving Event

Bitcoin Daily Price Chart

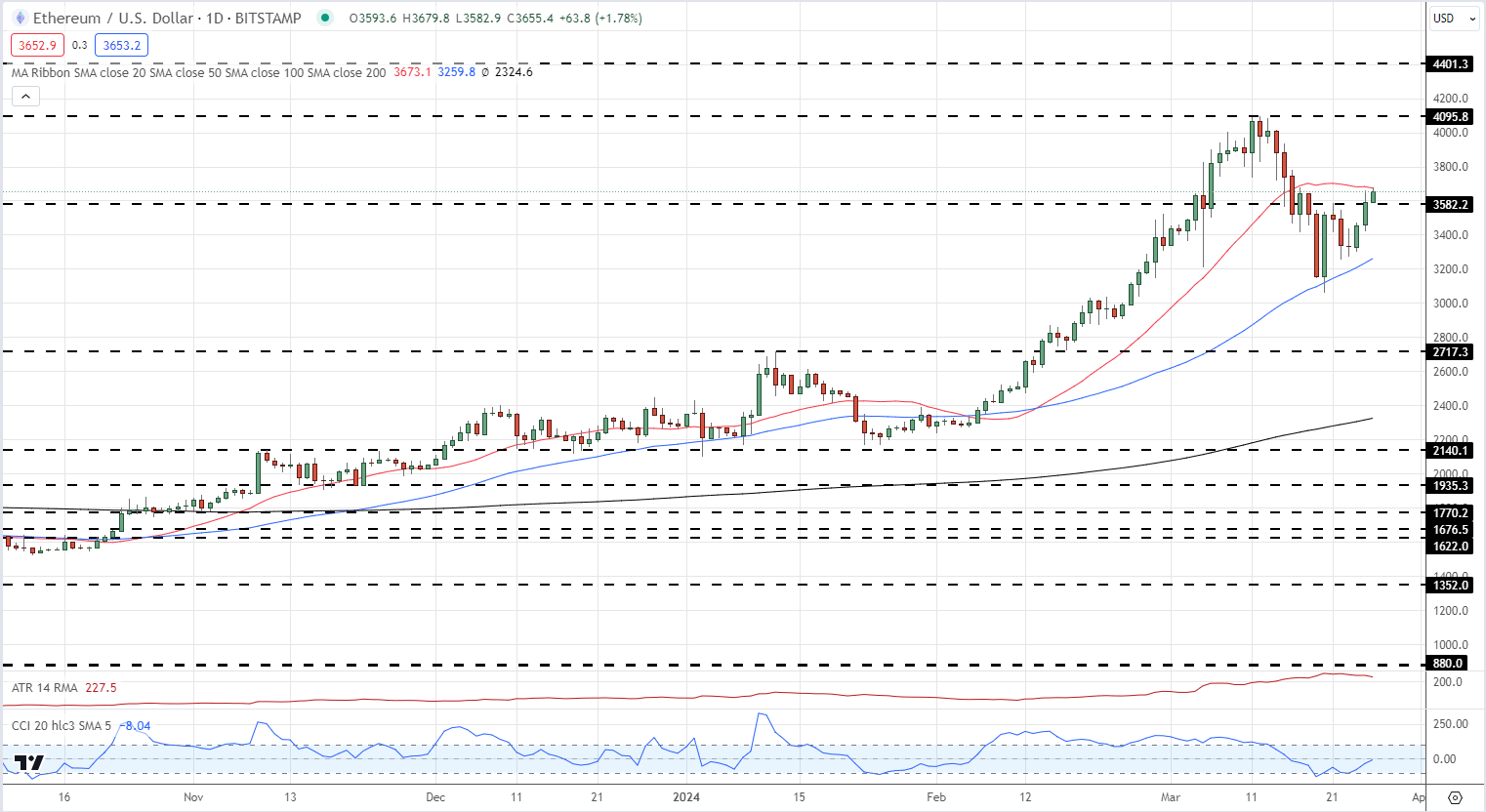

Ethereum is also pushing higher but continues to lag Bitcoin. While Bitcoin has already made a new ATH, Ethereum remains around 30% its peak and is struggling to regain its mid-March multi-month high of around $4,100. The proposed Ethereum spot ETFs look like they will not be approved by May 23rd – the Van Eck ETF deadline date – and this is weighing on the cash Ethereum price. With the ETF potential approval being pushed further out, Ethereum may struggle to match Bitcoin’s performance over the coming weeks. Any further move higher will likely be kept in check by the mid-March high.

Ethereum Daily Price Chart

Ethereum Spot ETF – The Next Cab Off the Rank?

Recommended by Nick Cawley

Building Confidence in Trading

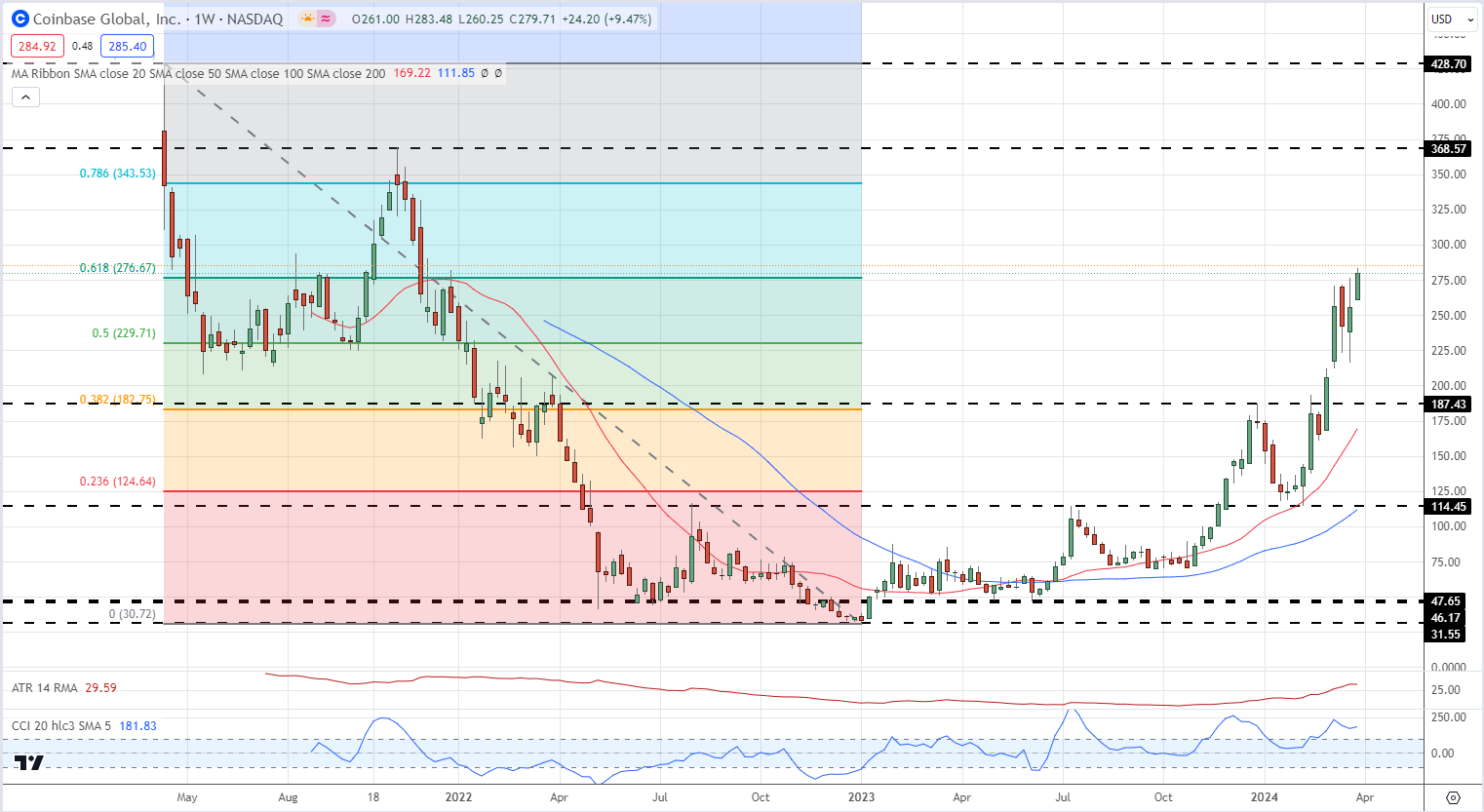

Coinbase (COIN), the largest cryptocurrency exchange in the US continues to benefit from the increased interest, and turnover, in the space. Coinbase shares are back at highs last seen in December 2021 and remain a proxy for overall crypto-market performance. Coinbase is trading around the 61.8% Fibonacci retracement of the May 2021 – January 2023 sell-off and targets the 78.6% retracement level at $343. Support on the weekly chart is seen at the 50% retracement level at $230.

Coinbase Weekly Price Chart

All charts via TradingView

What is your view on Bitcoin, Ethereum – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.