AUD/USD OUTLOOK:

- AUD/USD rises for the second straight day

- Despite today’s moves in FX markets, geopolitical tensions in the Middle East and rising U.S. Treasury yields create a hostile backdrop for the Australian dollar

- This article looks at key AUD/USD’s technical levels to watch this week

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Crude Oil Price Outlook – Bears Reload but Energy Market Outlook Stays Positive

AUD/USD extended its recovery on Tuesday, rising for the second day in a row and breaking above technical resistance in the 0.6350 area. Despite today’s price action, the Australian dollar maintains a negative profile against the U.S. dollar when evaluated through a combination of technical and fundamental analysis.

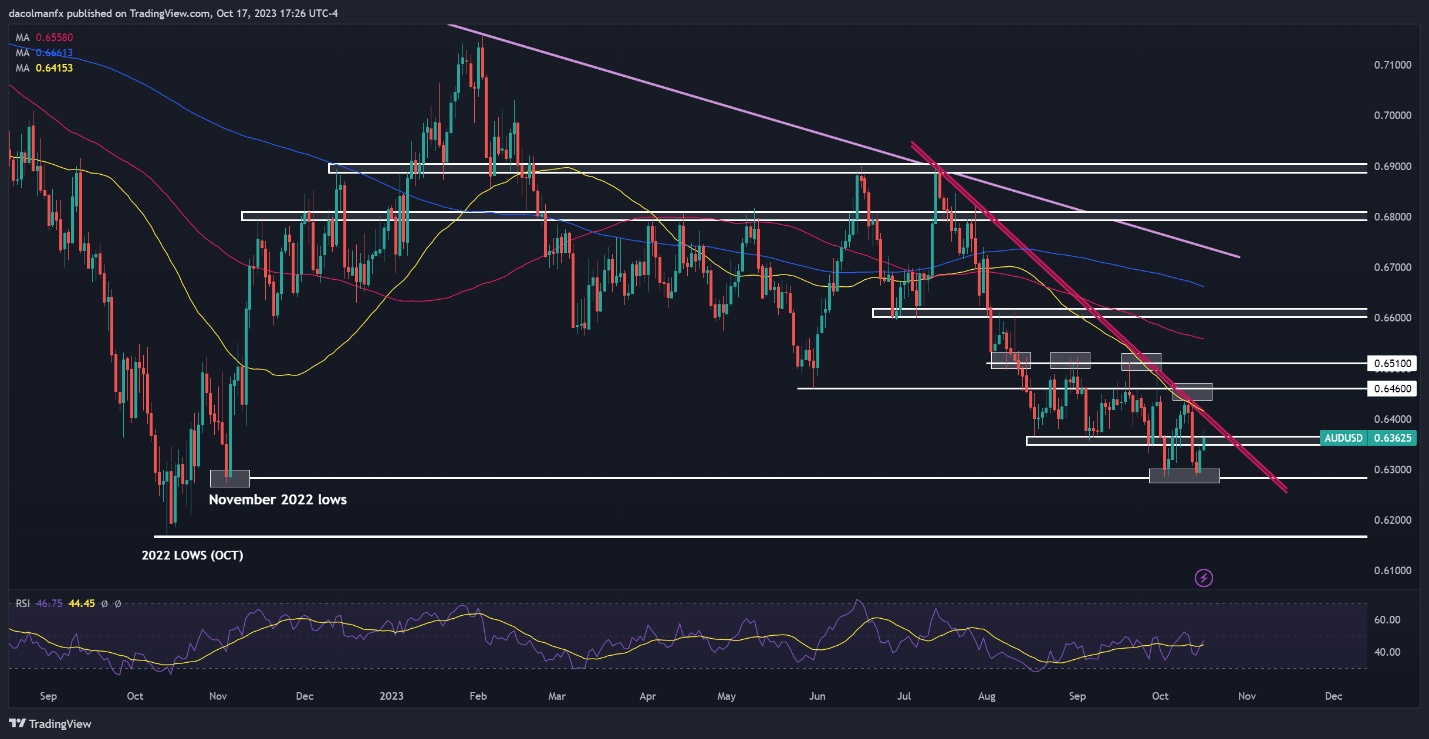

From a technical vantage point, the continuous sequence of lower highs and lower lows, coupled with the pair’s location below crucial moving averages and beneath a key descending trendline that has been shaping market trends since July, collectively strengthen the earlier assessment of a bearish outlook.

In the realm of fundamentals, the surge in U.S. Treasury yields, fueled by the remarkable resilience of the U.S. economy, and the Fed’s determination to keep interest rates high for an extended period of time in pursuit of price stability create a difficult and rather hostile environment for the Aussie.

The geopolitical climate in the Middle East is also a source of vulnerability for the Australian currency. Although Israel has so far postponed its potential invasion of the Gaza Strip, a ground incursion into the coastal enclave remains a strong possibility in the coming days.

Any escalation of the Israeli-Hamas clash could raise the geopolitical temperature in the region, especially if it draws in other actors like Iran. This scenario could lead to episodes of flight to safety and increased market turbulence, triggering a sell-off in riskier currencies.

Want to stay well-informed about the Australian Dollar’s future and the key market catalysts to watch? All the answers are in our Q4 trading guide. Don’t wait – grab your copy now!

Recommended by Diego Colman

Get Your Free AUD Forecast

Focusing on technical analysis, AUD/USD rebounded from support around the 0.6300 handle earlier in the week, clearing a key ceiling in the 0.6350 area in subsequent trading sessions. If the pair manages to hold above this region in the coming days, buyers could become emboldened to initiate an assault on trendline resistance at 0.6415. On further strength, we could see a move to 0.6460, followed by 0.6510.

Conversely, if sellers stage a comeback and spark a bearish reversal, initial support lies at 0.6350, but further losses may be in store on a push below this threshold, with the next downside target located in the 0.6300/0.6285 range. Further down the line, the focus shifts to last year’s low near 0.6170.

Interested in learning how retail positioning can shape the short-term trajectory of the Australian Dollar? Our sentiment guide has the information you need—download it now!

| Change in | Longs | Shorts | OI |

| Daily | -11% | 20% | -6% |

| Weekly | 12% | -19% | 3% |

AUD/USD TECHNICAL CHART

AUD/USD Chart Created Using TradingView