Gold, XAU/USD, US Dollar, Treasury Yields, Israel, Federal Reserve, GVZ Index – Talking Points

- The gold price appears comfortable above US$ going into Wednesday’s trading session

- Treasury yields are after making new highs again but gold appears unfazed by it

- The US Dollar has been choppy despite global uncertainty. Will XAU/USD remain bid?

Recommended by Daniel McCarthy

Get Your Free Gold Forecast

The gold price is holding the high ground on perceived haven status despite the return on US government bonds rising to multi-year peaks.

The monetary policy-sensitive 2-year Treasury note traded at 5.24% overnight for the first time since 2006 after red-hot economic data forced the market to re-examine its outlook for the Federal Reserve’s tightening cycle.

US retail sales expanded by 0.7% month-on-month in September, a beat on the 0.3% forecast and slightly stronger than the burgeoning 0.6% for August.

Treasury yields raced higher across the curve with the 5- and 7-year bonds seeing the largest run-up, adding around 15 basis points each. The benchmark 10-year note traded within a whisker of the 4.88% seen earlier this month, the highest since 2007.

In the aftermath, the US Dollar has seen some gains against the Sterling, Yen and Canadian Dollar going into Wednesday’s session and it is mostly steady elsewhere. The Aussie Dollar is a notable exception where the RBA has signalled a more hawkish stance over the last 24 hours.

For gold, the increase in return of a risk-free, or at least a very low-risk, asset like Treasury bonds might normally challenge the price of the precious metal.

However, the unnerving geopolitical backdrop evolving in the Middle East may have seen some support for the perceived haven status for the yellow metal. The situation there appears to be continually evolving and a resolution seems a long way off.

For more information on how to trade the news, click through on the banner below.

Recommended by Daniel McCarthy

Introduction to Forex News Trading

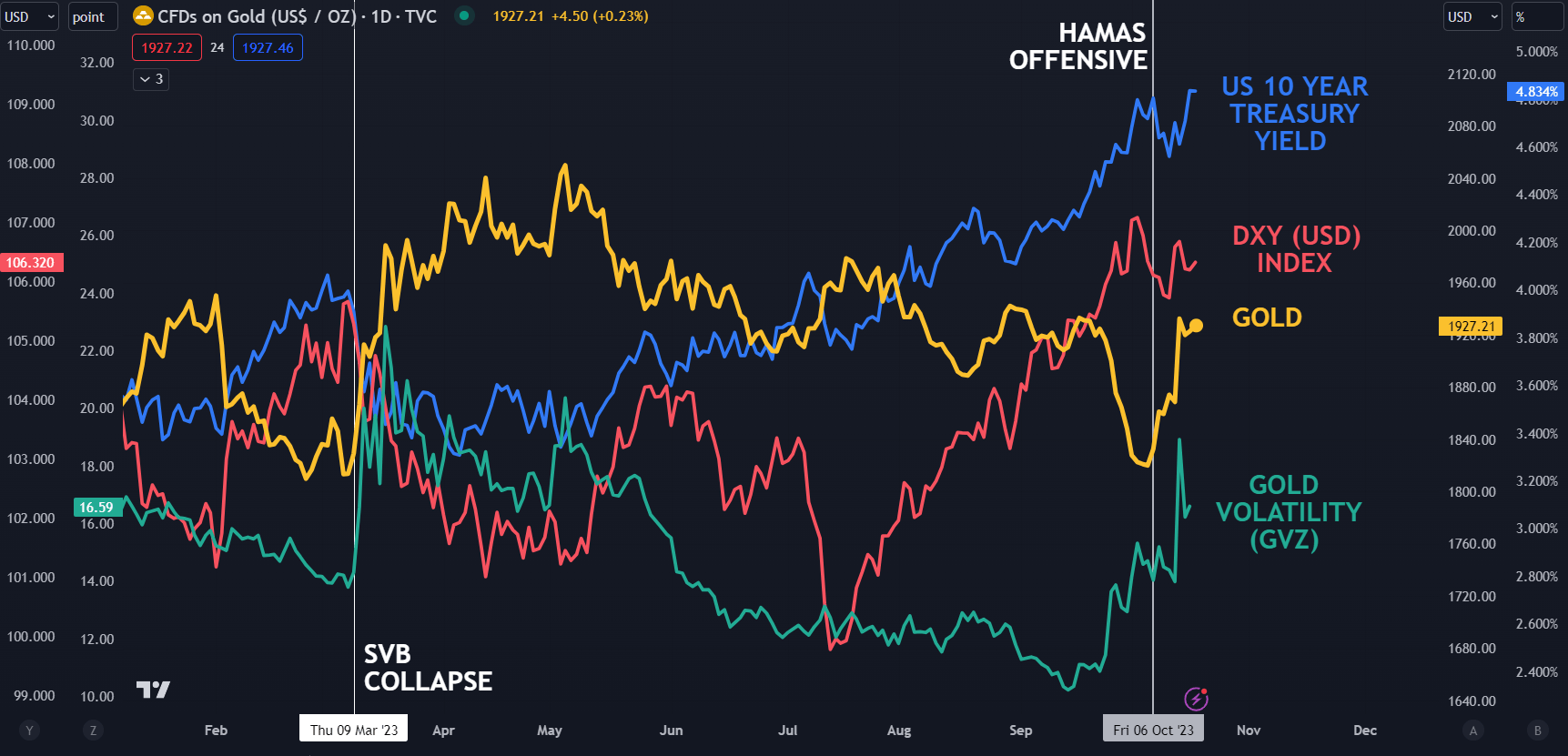

The conflict saw volatility tick higher as measured by the GVZ index, but it has since eased in the last few days. Treasuries were initially bought at the outbreak of the war, pushing yields lower, but that has since reversed.

Looking at the chart below, the rising 10-year Treasury yields and an uptick in the DXY (USD) index are yet to impact the gold price but it might be worth watching should those markets move abruptly.

The GVZ index measures volatility in the gold price in a similar way that the VIX index gauges volatility in the S&P 500.

SPOT GOLD, DXY (USD) INDEX, US 10-YEAR TREASURY AND GVZ INDEX

Chart created in TradingView

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter