US Dollar, Crude Oil, Treasury Yields, EUR/USD, AUD/USD, China GDP, Gold – Talking Points

- Euro rally is testing resistance while the Bank of Japan steps into the bond market

- China GDP was a solid beat, lifting AUD, supported by a hawkish RBA

- If the US Dollar regains the ascendency, will EUR/USD resume its downtrend?

Recommended by Daniel McCarthy

Get Your Free USD Forecast

The US Dollar has slipped through the Asian session after making some headway overnight on the back of Treasury yields pushing toward multi-year peaks.

US retail sales rose by 0.7% month-on-month in September, higher than the 0.3% anticipated and slightly better than the burgeoning 0.6% for August.

Treasury yields leapt higher across the curve with the 5- and 7-year bonds seeing the largest gains, adding around 15 basis points each.

The monetary policy-sensitive 2-year Treasury note traded at 5.24% overnight for the first time since 2006 while the benchmark 10-year note traded within a whisker of the 4.88% seen earlier this month, the highest since 2007.

Despite the run-up in yields, spot gold rallied to a 1-month peak above US$ 1,940 as the fallout from the rocket attack on a Palestinian hospital continues with both sides blaming each other.

The meeting between US President Joe Biden and Arab leaders has been put on ice and crude oil added over 2% as it eyes the highs seen last week.

The WTI futures contract traded up to US$ 88.80 bbl while the Brent contract touched US$ 92.18 bbl. Both contracts have eased going into the European session.

AUD/USD has been a notable mover in the last few sessions after yesterday’s hawkish RBA meeting minutes were backed up by RBA Governor Michele Bullock’s comments at a summit today. Interest rate markets now have a 25 basis point hike priced in by the end of 3Q 2024.

China’s GDP also assisted the Aussie Dollar after it came in at 1.3% quarter-on-quarter for 3Q, above the 0.9% forecast and 0.8% prior.

Chinese President Xi Jinping spoke at the Belt and Road forum in Beijing and talked up the initiative, adding that restrictions on foreign investment for manufacturing will be eased.

Meanwhile, China’s property sector continues to provide an anxious backdrop for investors with Country Garden bond holders yet to receive their latest coupon payments so far today.

APAC equities have had a mostly lacklustre day following on from Wall Street’s lead although China’s CSI 300 index has traded over 0.5% lower despite the upbeat GDP figures there.

The Bank of Japan lent into the bond market today to curd rising Japanese Government Bond (JGB) yields. The 10-year JGB nudged over 0.81% in pre-Japan trade for the first time since 2013. USD/JPY has had a quiet day trading above 149.50.

Looking ahead, after UK and Euro-wide inflation data, the US will see housing starts and building permits figures for September.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

How to Trade EUR/USD

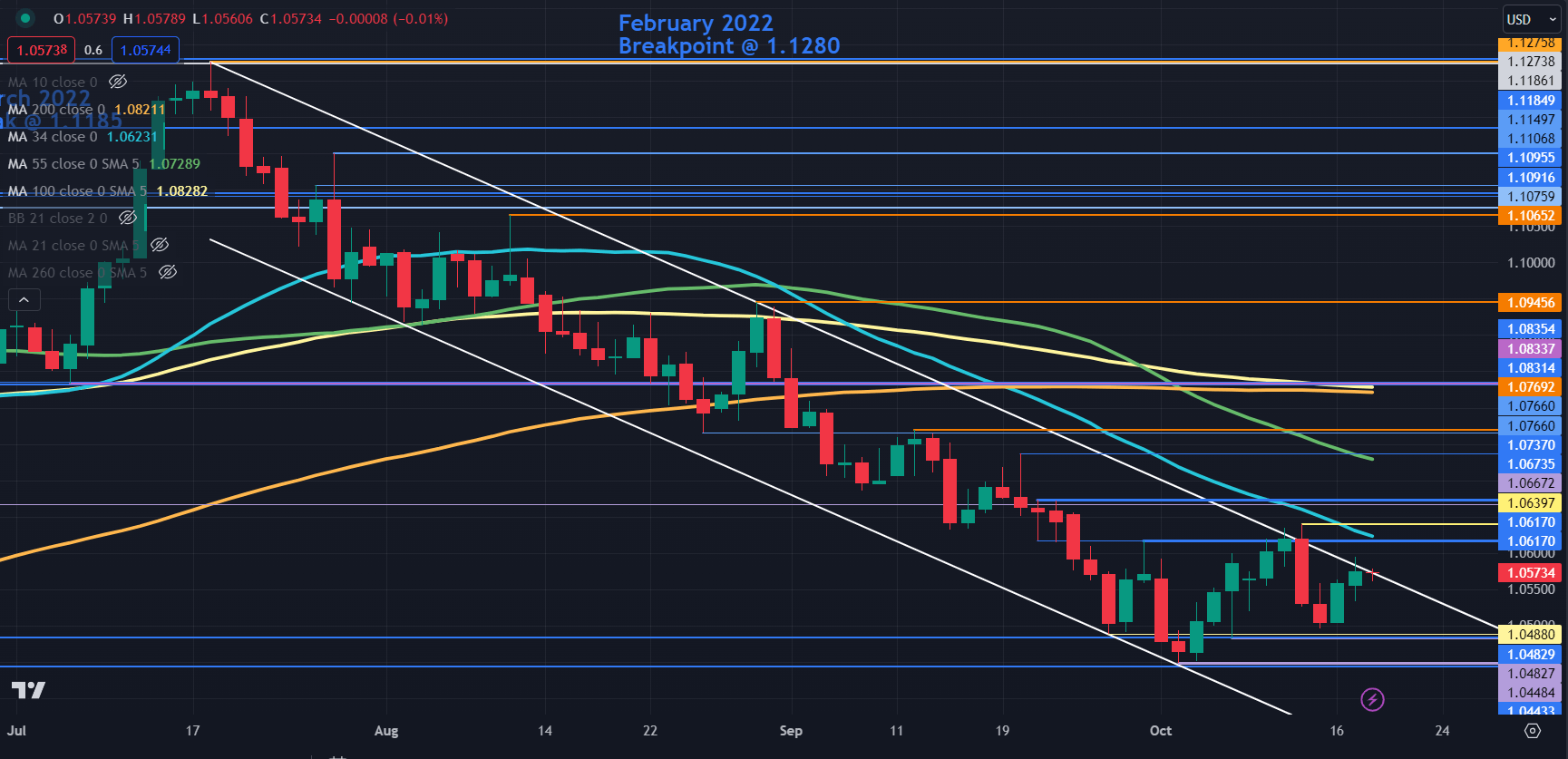

EUR/USD TECHNICAL ANALYSIS

EUR/USD steadied again today after it nudged higher overnight, testing the upper band of a descending trend channel.

A clean break above the trend line might signal that the overall bearish run might be pausing and a possible reversal may unfold if that were to occur.

To learn more about breakout trading, click on the banner below.

Recommended by Daniel McCarthy

The Fundamentals of Breakout Trading

Nearby resistance could be at the breakpoint and prior high near 1.0620 which coincides with the 34-day simple moving average (SMA).

Similarly, resistance could be at another prior peak at 1.0673 which is near the 55-day SMA.

Above those levels, the 100- and 200-day SMAs may offer resistance near the breakpoint at 1.0830.

On the downside, support might lie near the breakpoints and lows of early 2023 that were tested recently with 1.0480 and 1.0440 as potential levels of note.

EUR/USD DAILY CHART

Chart Created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter