If you’re new to trading and would like to know how to develop confidence in trading, click on the free guide!

Recommended by Manish Jaradi

Building Confidence in Trading

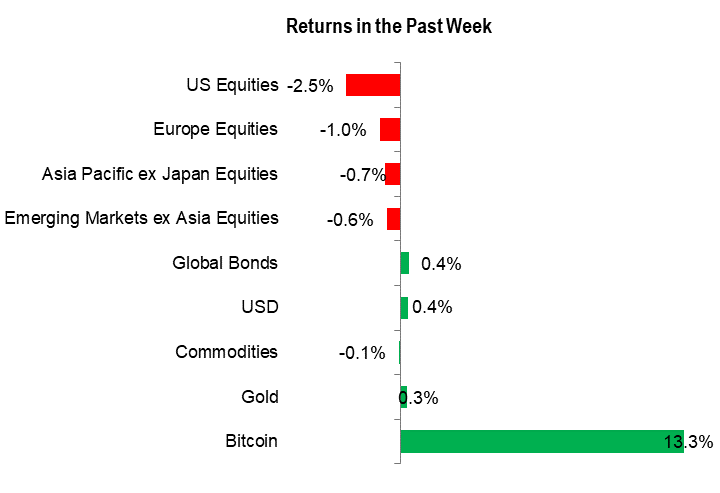

Global equity markets declined, led by the US on mixed third-quarter earnings, lingering uncertainties in the Middle East, and higher for longer interest rate outlook.

The MSCI All Country World index dropped 2.0%, the S&P 500 index fell 2.6%, and the Nasdaq 100 index declined 2.6%. The German DAX 40 fell 0.7% and the UK FTSE 100 dropped 1.4%. In Asia, the Hang Seng index fell 1.3%, while Japan’s Topix was mostly flat. Risk-sensitive currencies, including the Australian dollar and the New Zealand dollar, were mostly lower. Bitcoin continued its spectacular run, up 13% during the week.

Past week market performance

Source Data: Bloomberg; chart prepared in excel.

Note: Global Bonds proxy used is Bloomberg Global Aggregate Total Return Index UnhedgedUSD; Commodities proxy used is BBG Commodity Total Return.

Around 49% of the companies in the S&P 500 have reported actual results for Q3 2023 to date, of which 78% have reported actual EPS above estimates, according to FactSet. The S&P 500 is now reporting year-over-year growth in earnings for the first time since Q3 2022.

A key focus in the coming week is on the Bank of Japan meeting on Tuesday and the US FOMC meeting on Oct. 31-Nov.1. See “Central Banks, NFP and Soft EU Data in Focus Next Week,” published October 27.

Markets widely expect the Fed to hold rates next week after a number of Fed officials, including Fed chair Powell, earlier this month pointed out that tightening in financial conditions as a result of the jump in yields has reduced the need for imminent tightening.See “US Dollar Forecast: Could the Fed be the Catalyst for a Correction?, published October 29.

BOJ officials meet at a time when USD/JPY is within the zone that prompted the BOJ to intervene last year. Japanese authorities have warned against selling the yen, saying they are closely watching moves with a sense of urgency. Speculation is rife that BOJ could further tweak its yield curve control policy next week amid rising global yields and inflation in Japan.See “Japanese Yen Forecast: Bank of Japan and Fed Decision to Shape USD/JPY’s Path,” published October 29.

Meanwhile, the Bank of England is widely expected to keep interest rates on hold when it meets next week as the central bank tries to help boost the ailing economy while at the same fightinginflation. For more details see “British Pound (GBP/USD) Weakens Further Ahead of BoE Decision,” published October 28.

Germany’s Q3 GDP and October inflation are due on Monday. Bank of Canada governor Macklem’s speech, Japan unemployment, China NBS Manufacturing PMI, BOJ decision, Euro area October inflation and Q3 GDP, and US consumer confidence are due Tuesday. New Zealand Q3 jobs data, US ISM Manufacturing, and ADP Employment data are due Wednesday. US Fed rate decision, Bank of Canada governor Macklem speech, Germany jobs data, and Bank of England rate decision are due Thursday. China Caixin PMI, Canada jobs data, US non-farm payroll, and ISM Services PMI data are due Friday.

Gold, Silver Forecast: Bullish Run Cools but Upside Potential Remains

Gold and silver have witnessed a week of relative calm despite continued potential for conflict escalation. Elevated US yields keep gold below $2000 for the time being.

Euro Weekly Forecast: EUR/USD, EUR/JPY Remain Vulnerable Following Lackluster ECB Meeting

EUR/USD technicals are hinting at a recovery but we do have a lot of high impact data ahead. EUR/JPY continues to struggle for direction on the threat of FX intervention by the BoJ. Will the week ahead provide any clarity?

Australian Dollar Forecast: The RBA is Ready to Rock but AUD May Still Struggle

The Australian Dollar remains hostage to the US Dollar as global macro factors outweigh the prospect of the RBA looking to stamp out pesky inflation. AUD/USD and AUD/JPY are in focus.

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Recommended by Manish Jaradi

Improve your trading with IG Client Sentiment Data

— Article Body Written by Manish Jaradi, Strategist for DailyFX.com

— Individual Articles Composed by DailyFX Team Members

— Contact and follow Jaradi on Twitter: @JaradiManish