Japanese Yen, USD/JPY, US Dollar, BoJ, Treasuries, Powell, Crude Oil, Gold – Talking Points

- Japanese Yen weakness might trigger a BoJ reaction if it runs too far

- US Dollar resumed strengthening as worries mount for war escalation

- Fed Chair Powell will be crossing the wires today. His comments might boost USD/JPY

Recommended by Daniel McCarthy

Get Your Free JPY Forecast

The Japanese Yen appears to be looking to test the Bank of Japan’s (BoJ) resolve on Thursday while risk and growth-aligned assets are under pressure with the Middle East conflict weighing on sentiment.

USD/JPY is bumping up against the high for the year of 150.16 which was seen earlier this month. The bid tone for the exchange rate comes with the US Dollar seeing strength across the board as Treasury yields soar going into the latter part of the week.

The benchmark 10-year note traded to its highest yield since 2007 in Asia today as it scopes a move potentially above 5%.

After the commentary from several Fed speakers over the last week or so, attention will turn to Fed Chair Jerome Powell when he delivers an address on Thursday to the Economic Club of New York later today.

With US government bond yields racing north in the last few sessions, any comments around the impact for the Fed funds target rate could see heightened volatility.

Back in Japan, former board member at the BoJ Makoto Sakurai made comments today that he thinks that the bank is more likely to abandon negative interest rates before any further adjustments to yield curve control (YCC).

Mr Sakurai noted last year that the bank might loosen YCC controls months prior to the bank doing so. Yields on 10-year Japanese Government Bonds (JGB) nudged 0.84% today, the highest since 2013.

The BoJ will hold its monetary policy meeting on October 31st.

Elsewhere, crude oil has eased today after punching to a 2-week high overnight. The US Treasury Department announced that they will suspend sanctions on Venezuelan oil, gas, gold and bonds.

Spot gold also spiked above US$ 1,962 as the uncertainty surrounding diplomatic efforts in the Middle East assisted haven flows.

The Australian Dollar sunk after a mixed jobs report that saw the unemployment rate ease to 3.6% from 3.7%. The gains were made in part-time jobs while full-time jobs dropped on a lower participation rate.

APAC equities followed Wall Street’s lead lower with most of the major indices down over 1.5%. Futures are indicating a tough day ahead for equity markets in general across Europe and North America.

Aside from Fed Chair Powell’s speech, the US will also see data on jobs and home sales.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

Get Your Free Top Trading Opportunities Forecast

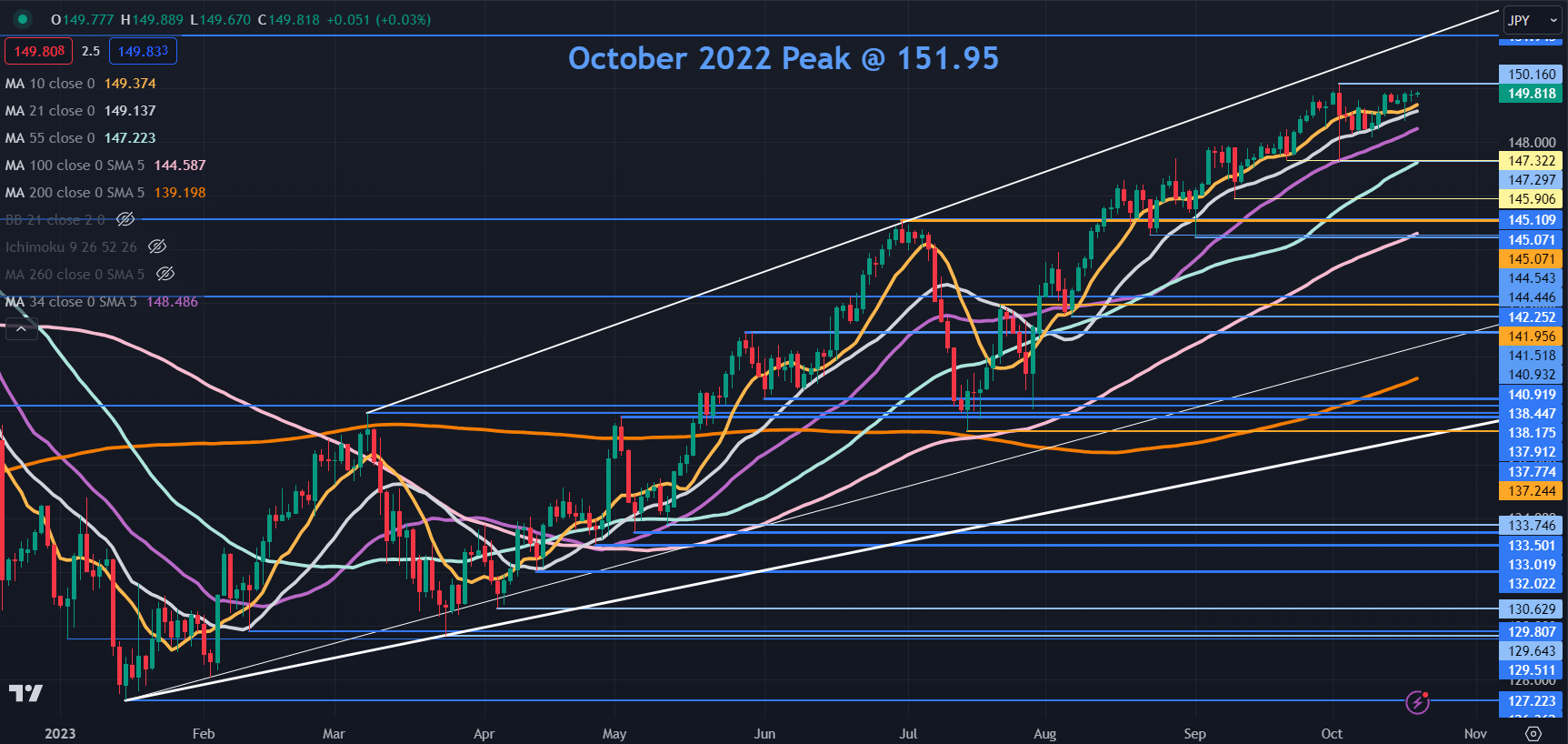

USD/JPY TECHNICAL ANALYSIS SNAPSHOT

USD/JPY is inching closer to the 12-month high seen at the start of October and a break above there could see a run toward the 33-year peak seen at this time last year at 151.95.

Such a move risks the possibility of the Bank of Japan (BoJ) physically intervening in the foreign exchange market.

A bullish triple moving average (TMA) formation requires the price to be above the short-term SMA, the latter to be above the medium-term SMA and the medium-term SMA to be above the long-term SMA. All SMAs also need to have a positive gradient.

When looking at any combination of the 10-, 21-, 34-, 55-, 100- and 200-day SMAs, the criteria for a TMA have been met and might suggest that bullish momentum is evolving. For more information on trend trading, click on the banner below.

On the downside, support may lie at the recent lows near 147.30 and 145.90 or further down at the breakpoints in the 145.05 – 145.10 area ahead of the prior lows near 144.50 and 141.50.

Recommended by Daniel McCarthy

The Fundamentals of Trend Trading

Chart created in TradingView

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter