Bank of England Preview

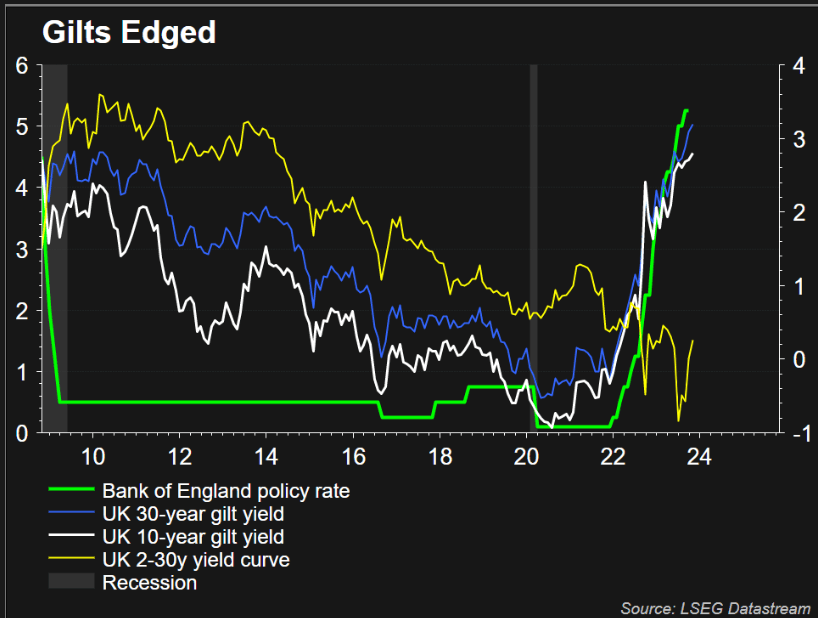

- Interest rates are expected to remain on hold as price pressures ease

- BoE may discuss a rethink of their QT process as the ‘term premium’ complicates the selling of longer-dater issuances

- Markets look to incoming economic data for clues on economic stress, GDP up next

- UK housing market squeeze and lowest level of mortgage applications since January

Customize and filter live economic data via our DailyFX economic calendar

Inflation and General Price Pressures Drop at a Slow Pace

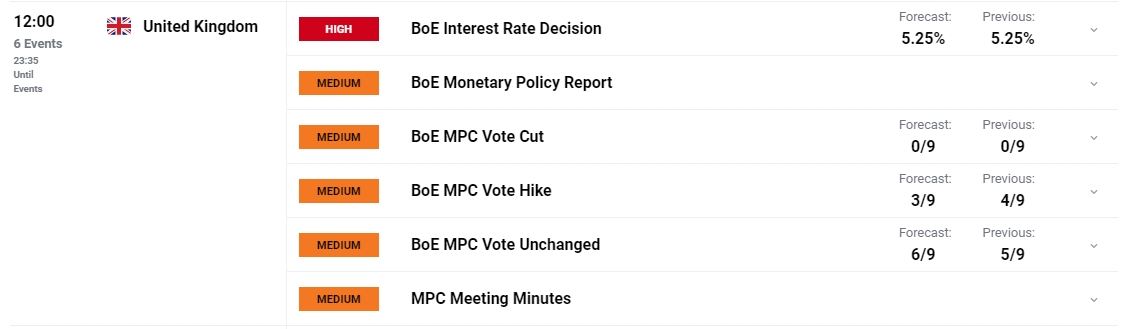

While inflation has been falling in the UK, the level of inflation remains the highest amongst major economies and has proven very stubborn to contain. Bank of England (BoE) officials have been stating throughout most of 2023 that inflation would drop off sizably, however, actual prices have resisted the effects of tighter financial conditions to a large degree.

Headline CPI has shown the most progress as oil and gas prices have fallen on average since the Russian invasion of Ukraine. Core inflation (inflation excluding volatile fuel and food prices) has declined at a slower rate than before, revealing widespread price pressures which have take hold. Services inflation – a measure strongly watched by the BoE has actually picked up, adding further to the Bank’s view that rates need to remain restrictive. The Monetary Policy Committee (MPC) will want to see future data heading lower before even considering a change in stance.

Source: LSEG Datastream, prepared by Richard Snow

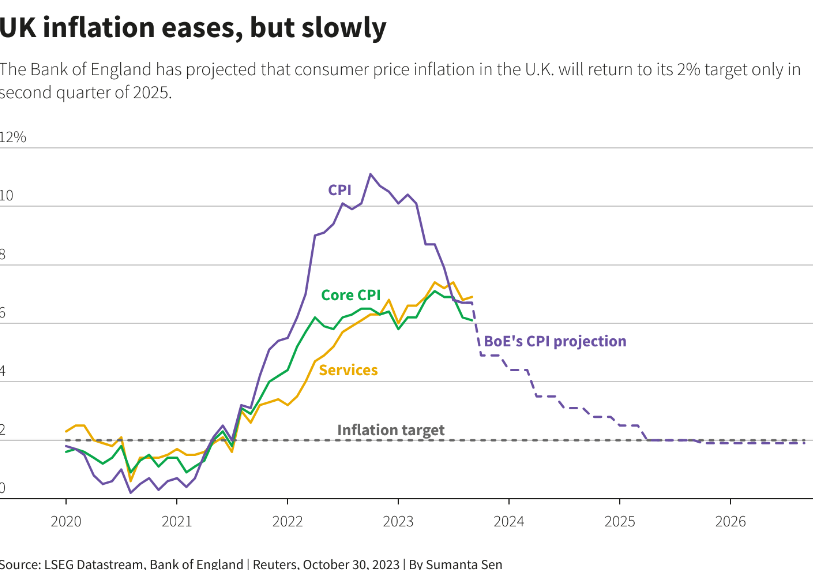

UK Job Market Eases but Challenges Appear Along the Way

The most recent jobs data showed that UK salary growth had eased but remains uncomfortably high at 8.1% year on year, down from a high of 8.5%. The unemployment rate has been trending higher but August data revealed a move to 4.2% on an adjusted basis. The labour market is easing in a manner that would satisfy the Bank of England that tighter financial conditions are having the desired effect in order to bring down inflation but this becomes a delicate balancing act as rising unemployment risks throwing the economy into recession. While average wages remain elevated the MPC will be motivated to maintain restrictive monetary policy.

UK Average Weekly Earnings

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Introduction to Forex News Trading

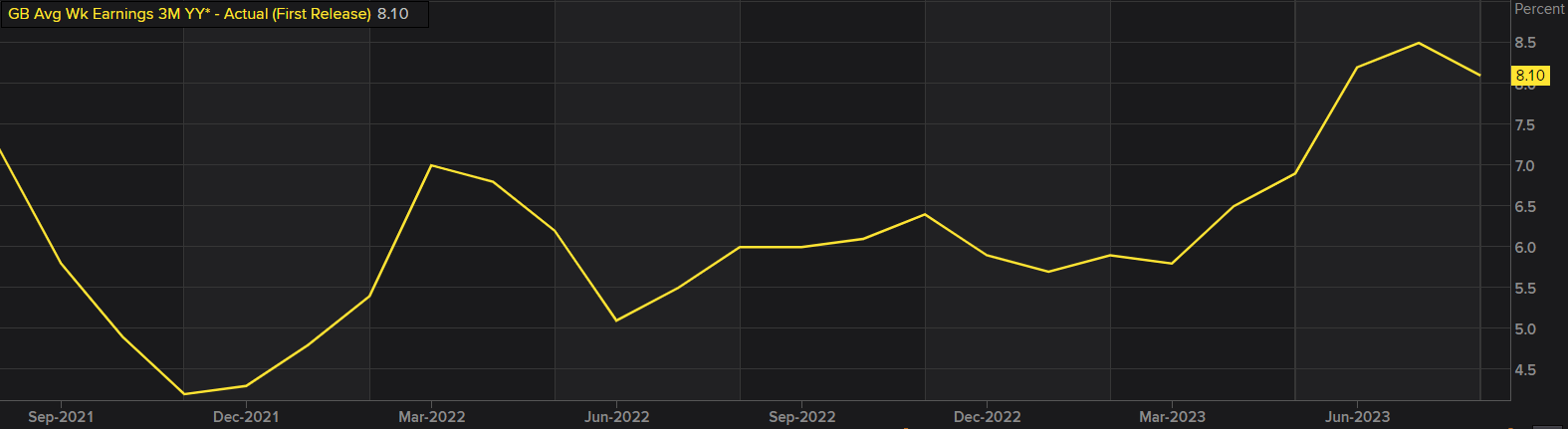

Quantitative Tightening (QT) May Require a Rethink

Rising global bond yields are in part helping to further tighten financial conditions but it is almost impossible to assess its impact in basis points. The ‘term premium’ – a risk premium demanded by the market for keeping money locked up for longer periods of time – will likely entertain a conversation about the current deployment of quantitative tightening by the Bank of England.

In September the bank picked up the pace of QT to 100 billion pounds over the next year, up from 80 billion pounds prior. However, a rise in longer dated Gilt yields means that securities are being sold off at a fraction of the cost they were acquired at. Yields and bond prices have an inverse relationship meaning the higher the yield, the lower the price of the security. Therefore, the BoE may decide to consider scaling back on longer-dated sales in favour of a more skewed approach towards shorter durations.

Source: LSEG Datastream

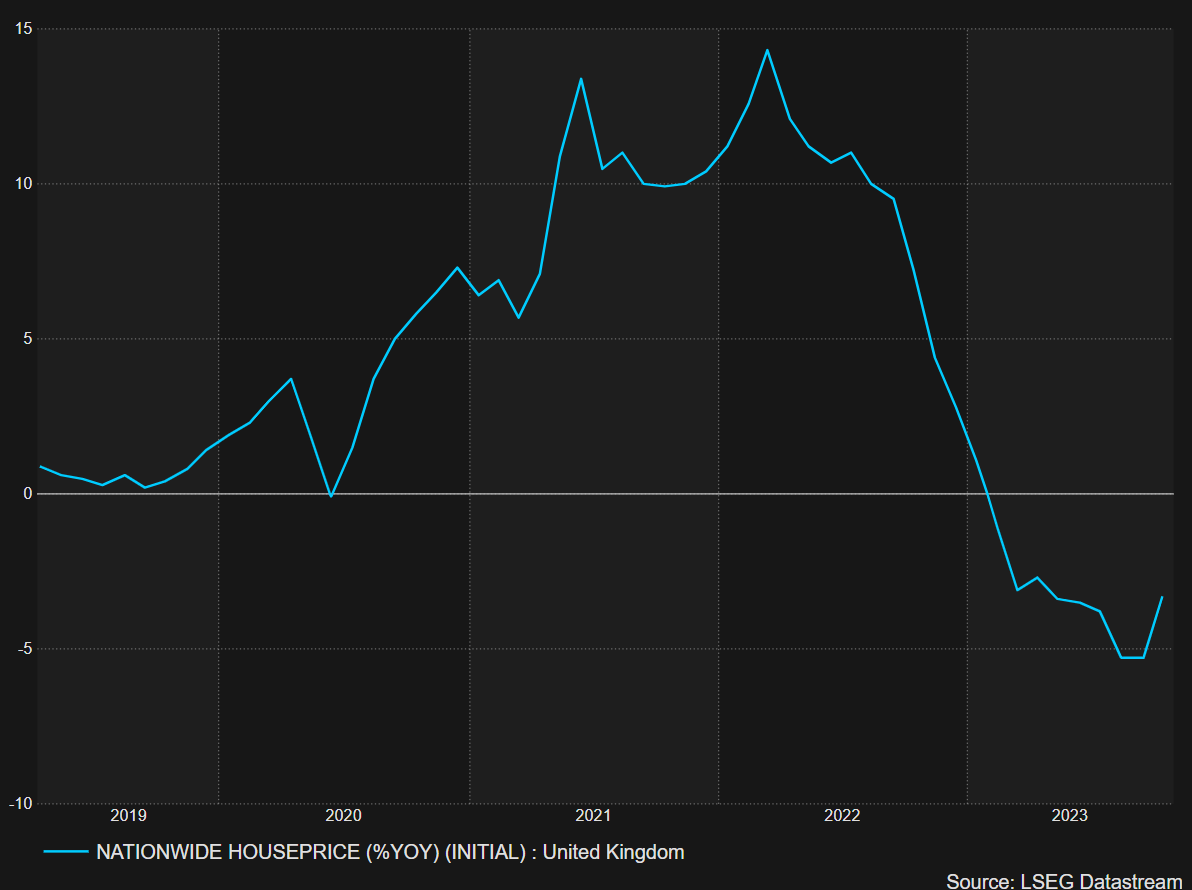

UK Housing Market Squeezed

After booming during the Covid period, the UK housing market has registered lower average prices during 2023 as rising mortgage rates continue to squeeze household budgets, disincentives new finance applications. The longer interest rates are held in restrictive territory, the housing market will have to endure further challenges.

UK Nationwide Housing Price Index (YoY)

Source: TradingView, prepared by Richard Snow

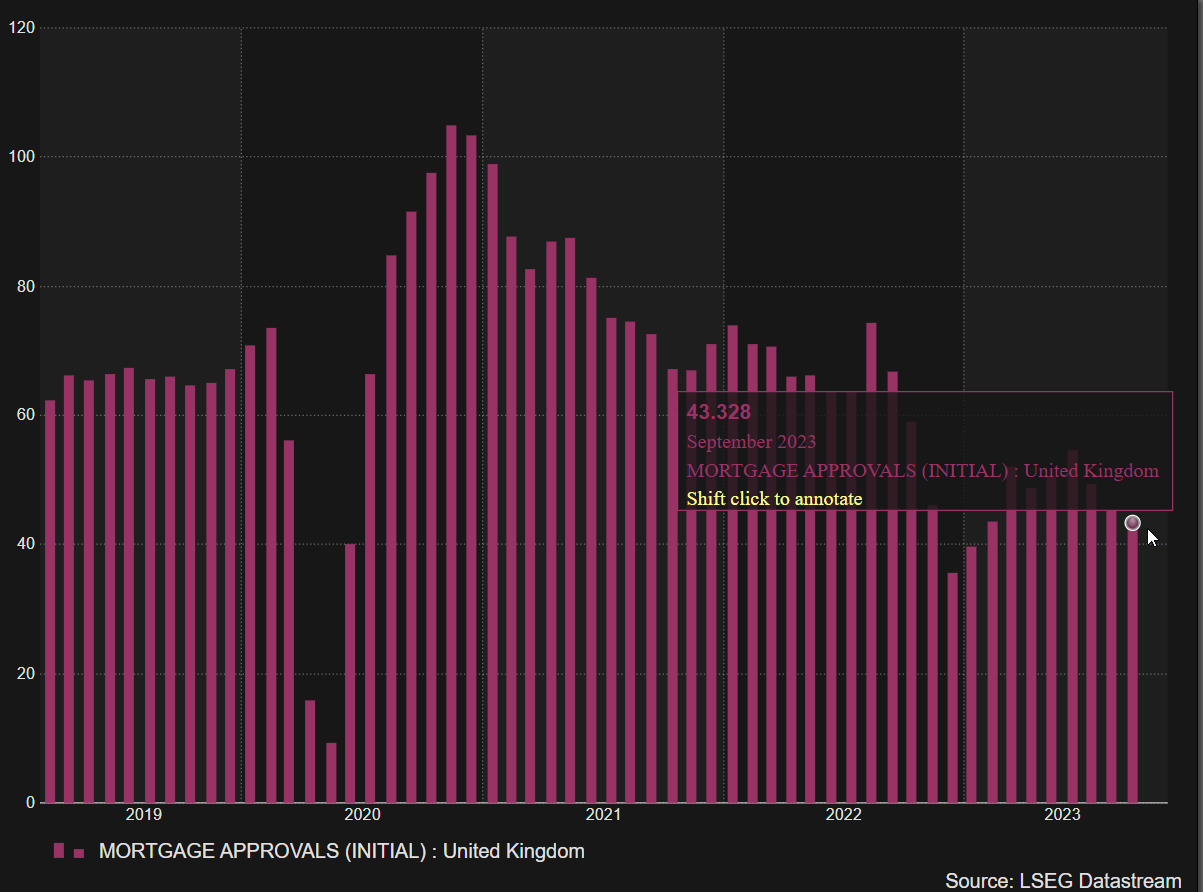

UK mortgage approvals have dropped to levels not seen since the start of the year as lending institutions are having to be more selective in their application process given the increased risk of default. Unemployment is on the rise and interest rates continue to restrict household and consumer spending – making mortgage repayments tougher to manage. Given the rising pressure on the UK economy, the bar for further rate hikes remains high.

The Bank of England is therefore more likely to maintain interest rate policy unchanged with the risks of overtightening and not tightening enough appearing more balanced.

UK Mortgage Approvals

Source: TradingView, prepared by Richard Snow

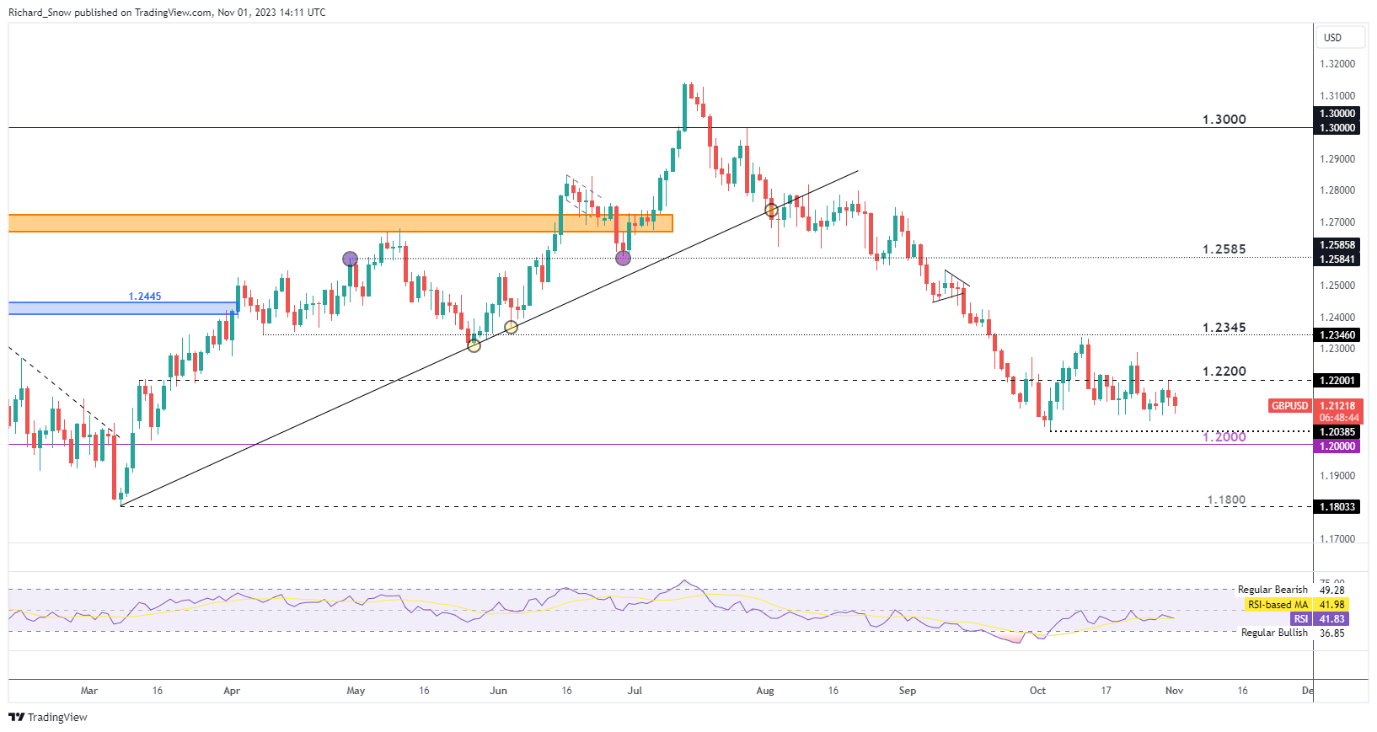

Pound Sterling Struggles for a Bullish Catalyst

Cable (GBP/USD) has attempted to lift off its prior low but has struggled to achieve any meaningful follow through. Markets have all but removed any prior support for the pound that previously existed via rising interest rate expectations and the currency is now subject to minor revisions based on incoming data.

Recommended by Richard Snow

How to Trade GBP/USD

In such conditions and particularly against the dollar, the pound is at risk of coming under pressure. The US continues to experience surprises to the upside when it comes to economic data, elevating the chances of one more rate hike and further depreciation in the pair. 1.2200 remains the current level of resistance with the swing low of 1.2000 also in play ahead of the announcement with 1.1800 representing a full retracement of the March to July advance.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX