For an extensive analysis of gold’s fundamental and technical outlook, download our complimentary quarterly trading forecast now!

Recommended by Diego Colman

Get Your Free Gold Forecast

GOLD PRICE TECHNICAL ANALYSIS

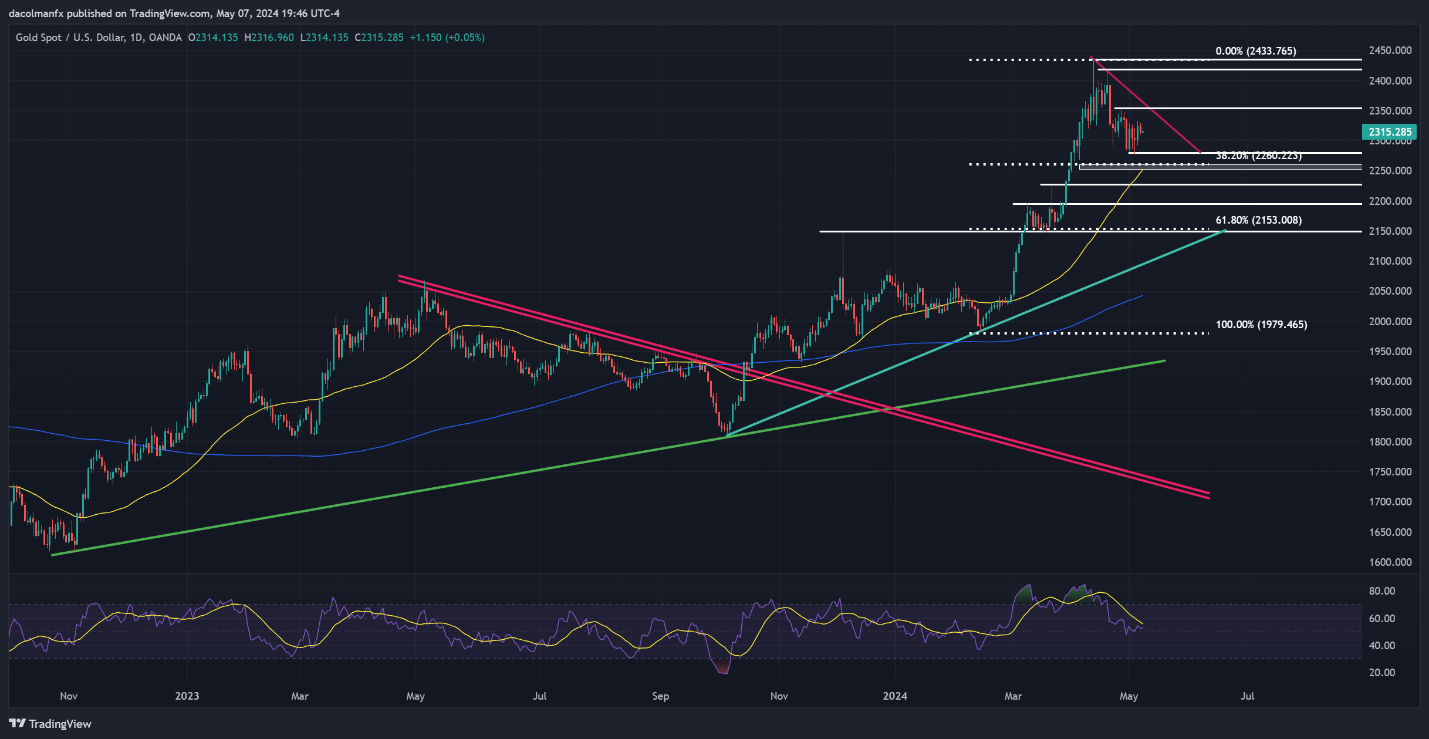

Gold (XAU/USD) took a step back on Tuesday following Monday’s solid performance, slipping by around 0.4% to settle near $2,315. Despite recent fluctuations to the upside and downside, the precious metal has not really gone anywhere in the past two weeks, with volatility shrinking over the period in question in a possible sign of consolidation and traders waiting for new catalysts before reengaging.

The market consolidation is not likely to end until prices either push past resistance at $2,355 or breach support at $2,280. Should resistance be overcome, the focus will turn to $2,415. Additional gains from this point forward may lead to renewed interest in the all-time high. Meanwhile, a break of support could trigger a fall towards a key Fibonacci floor at $2,260. Below this area, the spotlight will be on $2,225.

GOLD PRICE TECHNICAL CHART

Gold Price Chart Created Using TradingView

Stay ahead of the curve and improve your trading prowess! Download the EUR/USD forecast for a thorough overview of the pair’s technical and fundamental outlook.

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD FORECAST – TECHNICAL ANALYSIS

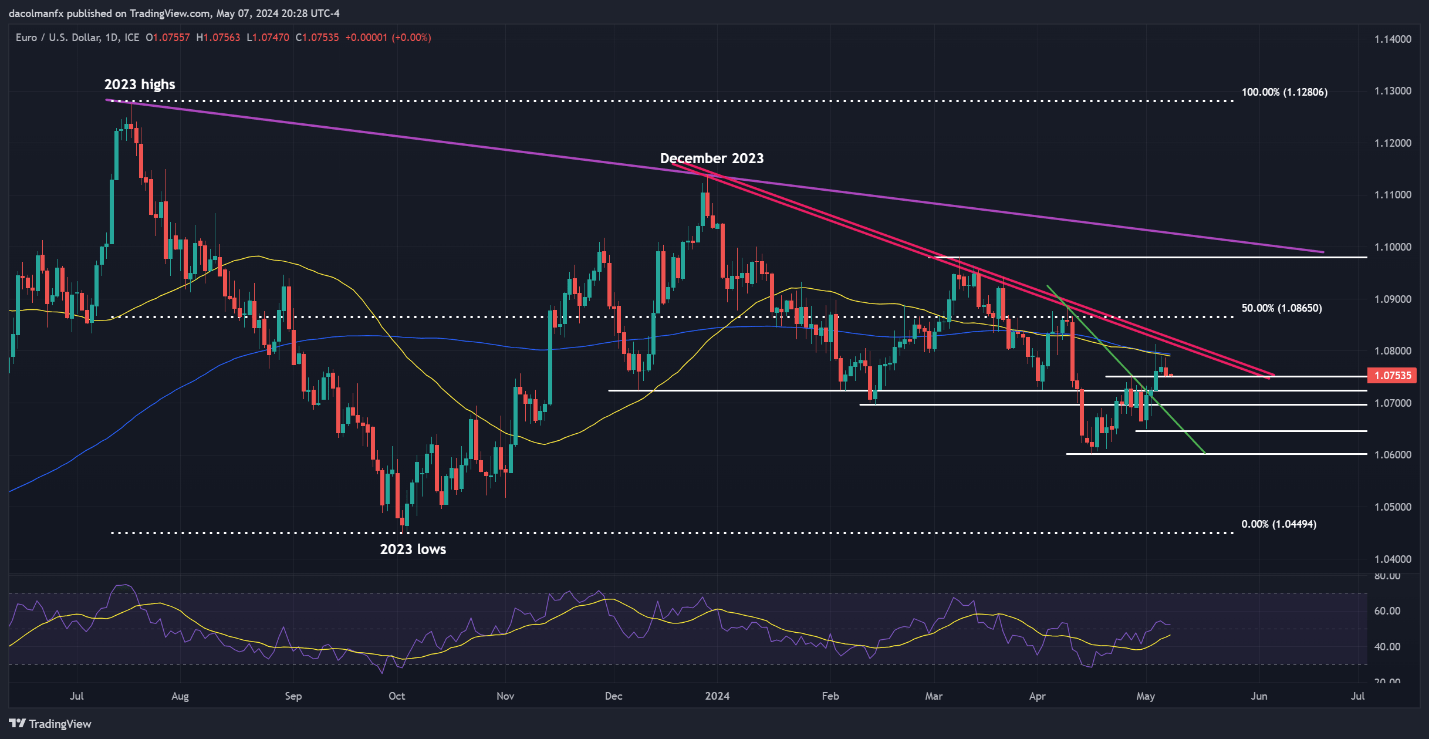

EUR/USD dipped slightly on Tuesday after a third failed attempt to break above its 50-day and 200-day simple moving averages at 1.0790, an area of strong resistance. Prices subsequently edged towards support at 1.0750. Maintaining this technical floor is essential to prevent a deeper retracement; failure to do so might lead to a move towards 1.0725 and possibly even 1.0695.

In the event of a bullish turnaround, the first ceiling to keep an eye on looms near 1.0790, followed by 1.0820, which corresponds to a medium-term downtrend line extended from the December 2023 highs. On further strength, bulls may feel emboldened to initiate an attack on the 50% Fibonacci retracement of the 2023 slump, located around 1.0865.

EUR/USD PRICE ACTION CHART

EUR/USD Chart Created Using TradingView

Curious about GBP/USD’s path ahead? Dive into our second-quarter outlook for expert analysis and strategies. Don’t hesitate—request your free guide today and gain an edge in your trading!

Recommended by Diego Colman

Get Your Free GBP Forecast

GBP/USD FORECAST – TECHNICAL ANALYSIS

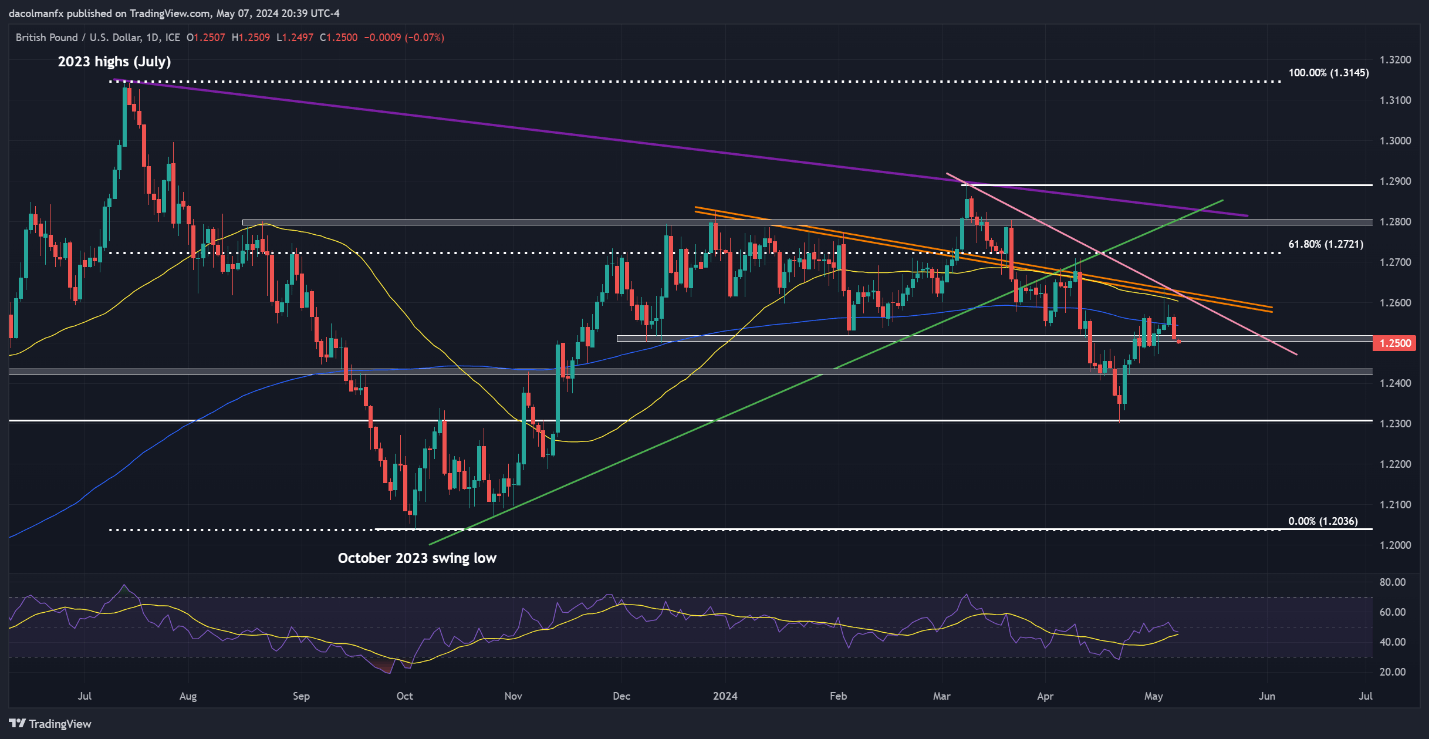

GBP/USD also fell on Tuesday, nearly breaching the 1.2500 handle. A decisive drop below this threshold in the upcoming days could amplify bearish pressure, potentially prompting a retest of technical support near 1.2430. While prices might find stability around these levels during a pullback before a rebound, a breakdown could pave the way for a retrenchment toward the psychological 1.2300 mark.

On the flip side, if buyers stage a comeback and propel cable above its 200-day simple moving average, confluence resistance stretches from 1.2600 to 1.2630, where the 50-day simple moving average intersects with two important trendlines. Upside clearance of this barrier could inject optimism into the market and boost the pound further, creating the right environment for a rally towards 1.2720.

GBP/USD PRICE ACTION CHART

GBP/USD Chart Created Using TradingView