Oil (Brent Crude, WTI) Analysis

- Oil struggles to reclaim lost ground as demand concerns outweigh geopolitical risks

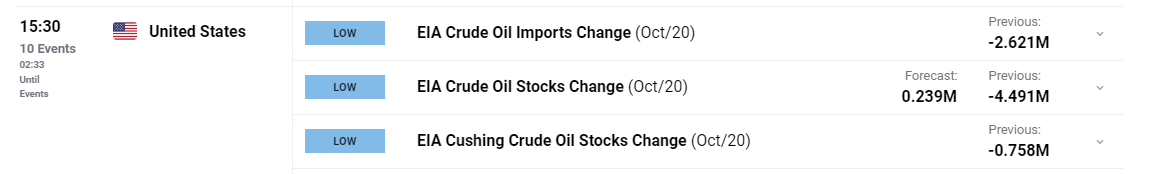

- API figures on Tuesday revealed a drop in American inventory levels. EIA storage data is due at 14:30 GMT

- IG client sentiment hints at further selling after recent repositioning

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

Oil Struggles to Reclaim Lost Ground as Demand Concerns Outweigh Conflict Risks

Oil prices have broadly declined over the last three trading session with an accelerated move yesterday after European PMI data was released. Dire manufacturing and services data in Europe underscored the headwinds facing the European economy, raising concerns over future oil demand.

Furthermore, bank lending across the euro zone was almost flat according to ECB data on Wednesday, adding to the tough times that lie ahead. Worsening credit conditions generally precede economic downturns.

However, on the upside Chinese officials approved a massive 1 trillion yuan in sovereign bonds in its latest attempt to stimulate the economy. It’s uncertain how long it may take for the stimulus to filter through the local economy but the news of the measures should buoy sentiment. Bear in mind China is the world’s largest oil importer but it remains to be seen if the latest stimulus efforts will be enough to revive activity.

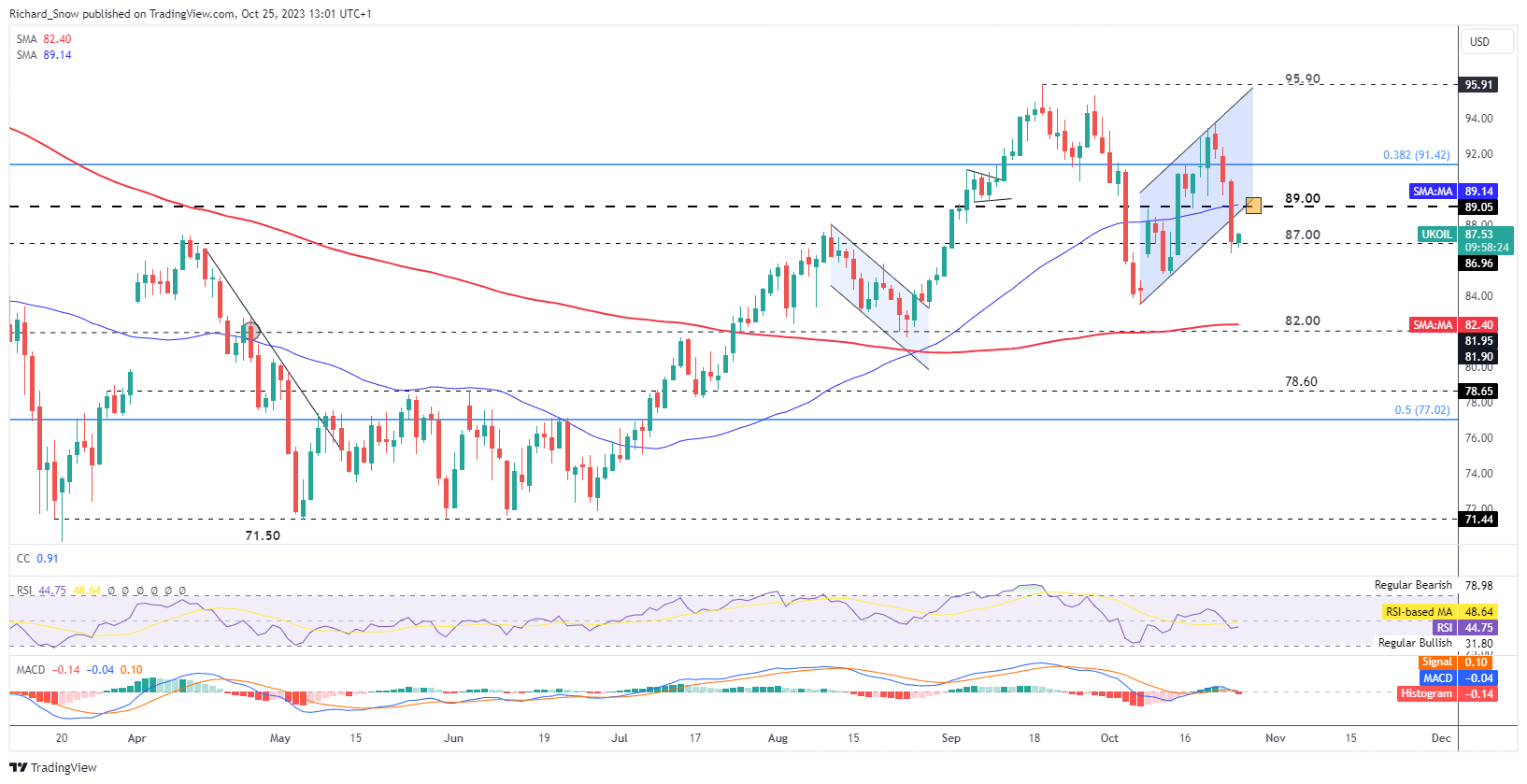

Brent crude oil has fallen through the lower bound of the ascending channel but appears to have found support at $87. A pullback towards $89 is not out of the question even if the bearish move is set to continue thereafter. The orange box highlights the intersection of the channel support (acting as resistance) and the $89 level. Resistance appears at $89 and could not be discounted during this time of conflict in the middle east. The ongoing conflict risks expanding into a broader regional conflict in an area of the world that produces a sizeable amount of the globes oil.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Keep an eye out for EIA crude storage data at 15:30 for updated figures:

Customize and filter live economic data via our DailyFX economic calendar

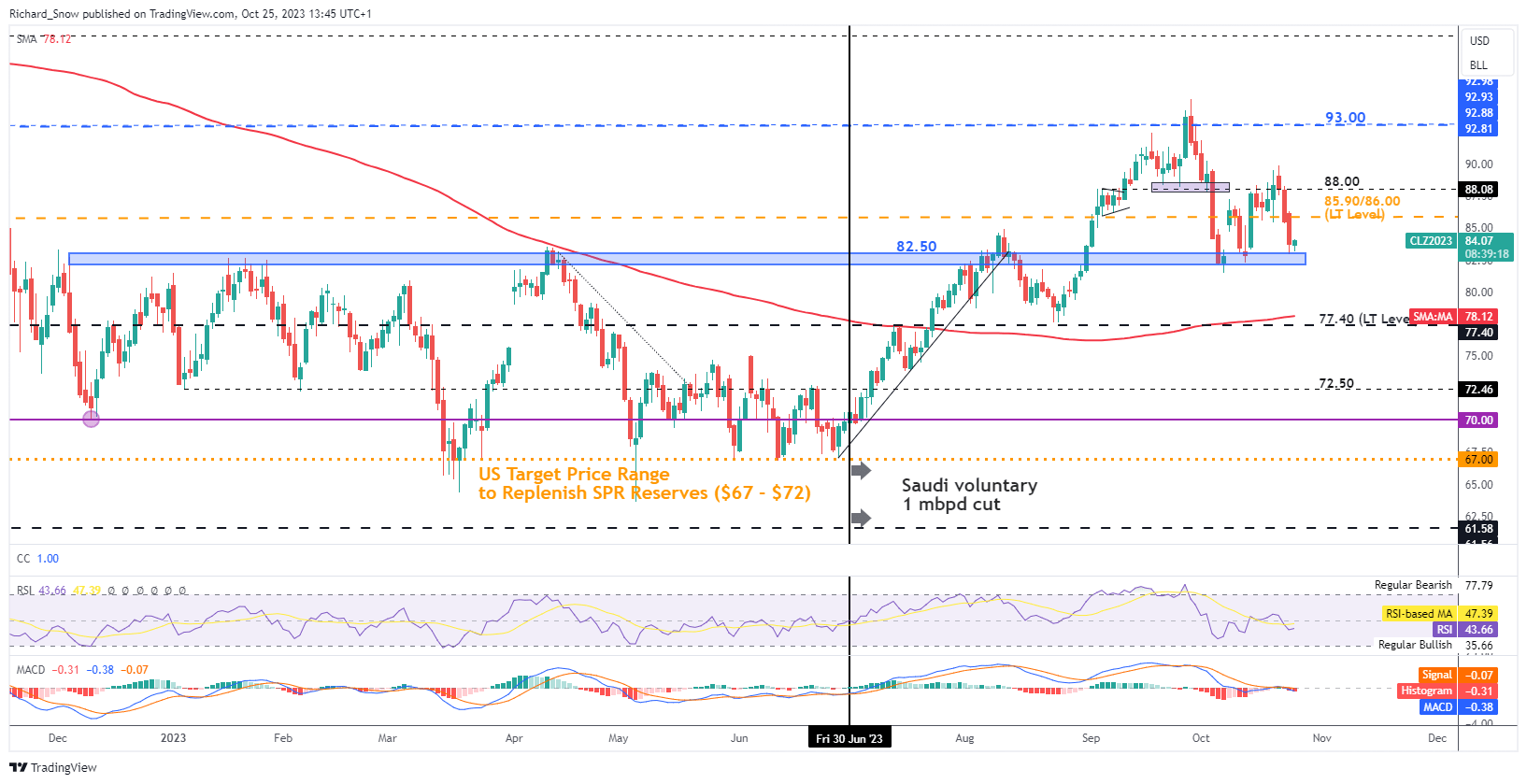

WTI oil now tests the prior zone of support around $82.50 after passing through $88 and $86 respectively. Much like Brent crude, WTI oil could attempt to retest $86 should support hold, allowing markets time to assess the next move.

WTI Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

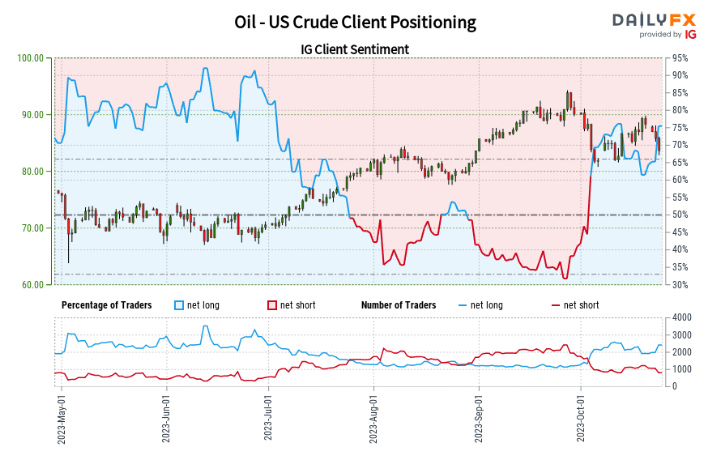

IG Client Sentiment Hints at Further Selling

A recent uptick in longs and considerable decline in shorts sees the contrarian indicator favouring further selling.

Oil– US Crude:Retail trader data shows 75.57% of traders are net-long with the ratio of traders long to short at 3.09 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggestsOil– US Crude prices may continue to fall.

The number of traders net-long is 14.38% higher than yesterday and 11.26% higher from last week, while the number of traders net-short is 15.93% lower than yesterday and 31.78% lower from last week.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Oil – US Crude-bearish contrarian trading outlook.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX